News

Original content

Three leading agribusiness companies, BASF, Corteva Agriscience, and MS Technologies, have partnered to introduce the first commercial nematode resistance technology for soybeans. This new genetic trait is designed to protect against major yield-reducing pests, such as root lesion and soybean cyst nematodes. The innovation will be integrated into existing Enlist E3® and Conkesta E3® soybean varieties, combining nematode protection with established herbicide and insect resistance. This will provide farmers with a more comprehensive and sustainable solution. The first cultivars with the new trait are expected to reach Brazilian farmers by the end of the decade, pending regulatory approval.

Statistics Canada (StatCan) forecasts a divided outlook for Canada's 2025 crop production based on new satellite and agro-climatic data. Production is expected to decrease for several key crops compared to 2024, including wheat (down 1.1%), barley (down 1.9%), and soybeans (down 7.3%), primarily due to lower yield estimates.

In contrast, output is projected to increase for canola by 3.6% to 19.9 million metric tons (mmt) and for grain corn by 1.4% to 15.6 mmt. The strong canola forecast surprised market analysts, who had anticipated a reduction due to dry conditions and a smaller planted area. A final report incorporating data from farmers is scheduled for release in December.

The 2025/26 season in Germany has begun with a significant price decline for locally produced soybeans and pulses. Producer prices for soybeans have fallen by 11% year-on-year (YoY) to USD 439.24 per metric ton (EUR 374/mt) compared to the previous year, while prices for field peas and beans have dropped by over 18% YoY. This downturn is influenced by both local and global factors.

Domestically, German farmers expanded the cultivation area by about 7% and are anticipating a satisfactory harvest. On the global stage, record soybean harvests are expected in the United States (US) and Brazil, while uncertain demand from China is pressuring international markets. Due to the low prices, which many farmers say do not cover costs, there is weak selling interest, with many producers choosing to store their crops and monitor the market.

India's soybean production for the 2025/26 season is projected to fall by nearly 15% YoY to 10.7 mmt compared to the previous year's record harvest. According to the United States Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS), the decline is driven by a 12% YoY reduction in harvested area, adverse weather, and farmers diversifying into more profitable crops like corn, rice, and sugarcane.

This reduced supply is expected to cause a 6% YoY decrease in soybean crushing and lower soybean meal production, as processors face tighter margins and competition from Argentine imports. Consequently, soybean meal ending stocks are forecast to plummet by 52% YoY.

Bayer has launched Cripton Ultra, a next-generation foliar fungicide designed to set a new standard for disease control in soybean crops, particularly against Asian rust and other late-season diseases. The product’s effectiveness stems from its triple-active ingredient mixture and proprietary Leafshield technology, which allows for rapid absorption and makes it resistant to being washed off by rain.

In a pre-launch phase in Paraguay, 120 producers who used the tool reported positive results, achieving an average yield increase of 172 kilogram (kg) per ha. This translated into an additional economic return of approximately USD 60 per hectare (ha). Experts emphasize that the fungicide's multiple modes of action are crucial for managing the evolving spectrum of pathogens that threaten soybean cultivation.

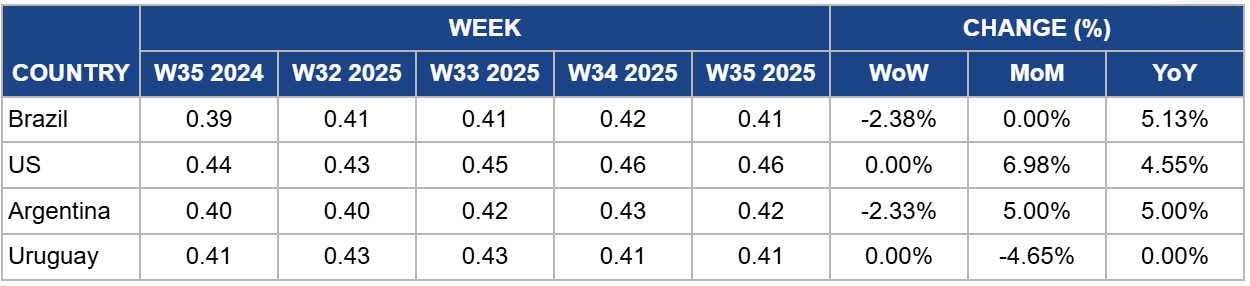

In W35, Brazilian soybean prices decreased to USD 0.41/kg, a 2.38% week-on-week (WoW) drop. However, prices were stable month-on-month (MoM) but showed a 5.13% YoY increase. The slight weekly dip is a minor market correction. At the same time, the annual price strength is sustained by continued robust export demand, especially from China, which continues to favor South American soybeans. This strong international demand provides a solid floor for prices. However, the appreciation of the Brazilian real against the US dollar has limited the complete translation of gains from the Chicago exchange into local prices for farmers. Looking ahead, the outlook for the 2025/26 crop is positive, with favorable weather forecasts for the planting season, which could increase supply and temper future price rallies.

In W35, US soybean prices held steady at USD 0.46/kg, with no change WoW. Prices registered a 6.98% MoM and a 4.55% YoY increase. The underlying price support stems from strong domestic fundamentals, including high crush rates as processors meet the demand for soybean meal and oil. This robust internal consumption has helped buoy prices despite significant external pressures. The primary headwind for the market remains the lack of demand from China for US supplies amid ongoing trade frictions. This absence of a key export destination is a primary concern for American farmers and is capping potential price increases. The situation is further complicated by the prospect of a large US harvest, which could weigh on the market if export sales do not improve.

In W35, Argentine soybean prices FOB fell to USD 0.42/kg, marking a 2.33% decrease WoW. Despite the weekly drop, prices remained strong with a 5.00% increase in both MoM and YoY. The weekly price movement is a minor adjustment, while the broader strength is tied to the global soy complex. The most significant price driver shaping the future outlook is a shift in farmer planting intentions for the 2025/26 season. Soybeans are becoming less competitive compared to alternatives like corn and barley. This is a direct result of higher export taxes on soybeans, which squeeze producer margins and make other crops more financially attractive, creating uncertainty around Argentina's future soybean supply.

In W35, Uruguayan soybean prices were stable at USD 0.41/kg, reflecting no change WoW or YoY. However, this reflects a 4.65% price drop MoM. The current stability suggests the market has found a temporary equilibrium after the previous month's decline, which was likely driven by localized factors such as the timing of farmer sales and the conclusion of major export programs. While prices in neighboring countries had risen, Uruguay's market corrected based on its specific logistical and supply dynamics. The market is now balancing these local factors against the broader regional trends, particularly the favorable production outlook across South America.

Agribusinesses, investors, and farmers should prioritize the adoption of next-generation agricultural technologies to mitigate risk and enhance productivity. The development of nematode-resistant soybeans in Brazil and the successful deployment of Bayer's Cripton Ultra fungicide in Paraguay highlight a clear trend toward integrated genetic and chemical solutions. Investing in these innovations is crucial for protecting crops against evolving threats like Asian rust and nematodes, ensuring more stable and profitable harvests in the long term.

Exporters in the US, Brazil, and Argentina should strategically target the Indian market, where a projected 15% drop in domestic production will create a significant import demand for soybeans and meal. This presents a prime opportunity for US suppliers to diversify away from China, where trade frictions persist. Concurrently, buyers and processors in Europe can leverage the current low-price environment in Germany, where a satisfactory harvest and global supply pressures have driven prices down 11% YoY, creating favorable purchasing conditions.

Producers and traders must respond to distinct regional challenges. In Argentina, the disparity in export taxes makes corn and barley more attractive than soybeans, requiring farmers to carefully assess crop profitability and potentially creating future supply uncertainty for buyers. US farmers should continue to focus on the strong domestic market for soybean meal and oil to offset weak export sales to China. In Canada, stakeholders should prepare for tighter soybean supplies and higher prices following the forecast of a 7.3% production decrease.

Sources: Tridge, Grain Trade, UkrAgroConsult, Productiva, AgroLink

Read more relevant content

Recommended suppliers for you

What to read next