News

Original content

In Aug-25, the Food and Agriculture Organization (FAO) Vegetable Oil Price Index rose 1.38% month-on-month (MoM) and 24.25% year-on-year (YoY) to 169.1 points. This uptick was driven by higher sunflower, palm, and rapeseed oil prices amid tighter Black Sea and European supplies, even as soybean oil prices moderated. Meanwhile, in its Sep-25 report, the United States Department of Agriculture (USDA) projected global sunflower oil production in the 2025/26 season to increase to 55.27 million metric tons (mmt), driven by higher output in Russia at 19 mmt and Kazakhstan at 2.4 mmt, offsetting reductions in Ukraine at 12.7 mmt and the European Union (EU) at 8.85 mmt. Rising production and tight old-crop seed supplies are supporting global sunflower oil prices, while international demand, particularly from India and China, remains strong. Russia continues to dominate exports, supplying between 58% and 63% of sunflower oil to key Asian markets, with flexitank shipments playing a growing role in overcoming logistical barriers.

High-oleic sunflower is experiencing a resurgence in the Black Sea region, driven by strong premiums that incentivize farmers to expand plantings in 2026. According to UkrAgroConsult, average sunflower yields for 2025/26 are expected to rise across key producing countries, with Ukraine at 2.28 metric tons per hectare (mt/ha), Russia at 1.8 mt/ha, Romania at 1.69 mt/ha, and Bulgaria at 1.95 mt/ha, despite heat and moisture stress in parts of South-Eastern Europe. In Ukraine, domestic processing will continue to dominate, with over 98% of the 13.3 mmt harvest converted into oil and meal, leaving less than 1% for seed exports. Sunflower oil remains the most expensive vegetable oil in key import markets, with premiums over palm and soybean oils supported by limited old-crop supplies and pent-up demand. The Danube ports, including Constanta, are expected to handle modest additional volumes of between 200 thousand mt and 300 thousand mt but will remain secondary to deep-sea ports.

The Turkish Grain Board (TMO) has provisionally purchased 18,000 mt of crude sunflower oil from Russia’s trading house Aston through an international tender, with deliveries scheduled between October 1 and October 31. The deal includes 6,000 mt priced at USD 1,256/mt cost and freight (CFR) for the port of Tekirdag and 12,000 mt at USD 1,253.80/mt CFR for Iskenderun and Mersin. This marked a slight increase from mid-Mar-25 prices of between USD 1,195/mt and USD 1,208/mt CFR. The reduction of Turkey’s import duties on sunflower oil from 36% to 30% and on oilseeds from 20% to 12% from October 1 is expected to boost supplies from Russia, potentially restoring Turkey as the leading importer of Russian sunflower oil. In the 2024/25 season, Turkey imported 855 thousand mt from Russia, ranking second after India. Notably, imports have already risen 17% YoY to 564 thousand mt in the first seven months of 2025. Domestically, the sunflower harvest has begun in Taşçılar Village, Bilecik, where planting area has expanded from 60,000 decares to 111,000 decares over four years. This expansion was supported by seed grants and efficiency programs, reflecting Turkey’s efforts to increase domestic production alongside growing imports.

The sunflower harvest in Ukraine is gaining momentum, with southern regions currently leading and central areas gradually joining, resulting in over 200 thousand mt harvested by early Sep-25. However, total harvest for the season reached 885 thousand mt as of September 11, a drop from 3 mmt harvested in the same period last year, with first-threshing yields of 1.55 mt/ha, 21% lower YoY. Short-term sunflower seed prices may rise by USD 2.42/mt (UAH 100/mt) to USD 7.27/mt (UAH 300/mt) weekly. However, increased volumes from northern and western regions later in Sep-25 could bring prices down to around USD 642.12//mt (UAH 26,500/mt). In particular, high-oleic sunflower is attracting strong demand due to its role in partially replacing the declining olive oil production in Mediterranean countries, with prices starting at USD 758.43/mt (UAH 31,300/mt) and potentially reaching USD 848.08/mt (UAH 35,000/mt) this winter. Processing plants have stepped up purchases amid starting stocks half the size of last year, driving competition. On the external market, northern European ports report spot premiums for sunflower oil exceeding USD 100/mt, strengthening demand for Ukrainian products.

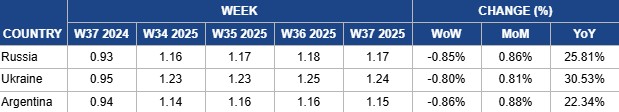

In W37, Russia’s sunflower oil export prices declined by 0.85% week-on-week to USD 1.17 per kilogram (kg). However, they remained 0.86% higher MoM and 25.81% above year ago levels. The sustained strength reflects robust global demand, with Russia supplying between 58% and 63% of sunflower oil to key Asian markets, supported by the growing use of flexitank shipments to ease logistical constraints. This demand was recently reinforced by the TMO’s provisional purchase of 18 thousand mt from Russia for delivery in Oct-25. Furthermore, Turkey’s decision to reduce import duties on sunflower oil from 36% to 30% and on oilseeds from 20% to 12% from October 1 is expected to further lift Russian exports and could restore Turkey as the leading importer of Russian sunflower oil.

In W37, Ukraine’s sunflower oil prices fell by 0.80% WoW to USD 1.24/kg. However, they remained 0.81% higher MoM and 30.53% above last year’s level. The weekly decline was likely influenced by expectations of higher global sunflower production in the 2025/26 season and the ongoing harvest in Ukraine. On the other hand, the sustained elevation reflects strong demand. Domestic processing continues to dominate in Ukraine, with more than 98% of the 13.3 mmt harvest converted into oil and meal, leaving less than 1% for seed exports. On the external front, demand for Ukrainian products remains firm, as northern European ports report spot premiums for sunflower oil exceeding USD 100/mt.

Argentina’s sunflower oil prices fell by 0.88% WoW to USD 1.15/kg in W37. However, they were still up 0.88% MoM and 22.34% YoY. The weekly drop was likely influenced by expectations of higher global sunflower production in 2025/26. Nonetheless, prices remain elevated, supported by record crushing volumes in Jul-25 that drove strong foreign currency inflows and by reduced export duties on soybean and sunflower products, which aim to expand Argentina’s share in global agricultural trade. Sunflower oil exports reached 218 thousand mt in Jul-25, the highest monthly level in four years, underscoring robust demand and strengthening Argentina’s global market position. While soybean processing declined due to limited domestic supply, sunflower oil output maintained high capacity utilization, keeping prices stable. Additionally, continued strong crushing and export demand are expected to provide support even as fluctuations in input supply and competition from other oilseeds may moderate gains ahead.

Given Russia’s dominant share of sunflower oil exports to India and China and the growing use of flexitanks, exporters should prioritize logistics solutions that reduce bottlenecks and expand market reach. Investing in containerized shipping via flexitanks and coordinating with key ports can help overcome regional transportation constraints, ensuring timely delivery to high-demand markets while maintaining premium pricing.

Farmers and agribusinesses in the Black Sea region should capitalize on the strong premiums for high-oleic sunflower seeds by expanding cultivation areas in 2026. Implementing precision agriculture techniques and climate-resilient practices can mitigate the effects of heat and moisture stress, while ensuring higher yields and maximizing returns from domestic processing and exports.

With Turkey lowering import duties on sunflower oil and oilseeds, trading houses and processors should adjust procurement strategies to secure larger volumes from Russia and other suppliers. Combining imports with domestic production expansion initiatives, such as seed grants and efficiency programs, will ensure a stable supply for the local market and help maintain competitive pricing.

Ukrainian producers and processors should target Mediterranean markets experiencing olive oil shortages by promoting high-oleic sunflower oil as a premium substitute. Coordinated marketing efforts, backed by competitive pricing and quality assurances, can capture demand spikes while leveraging strong premiums and limited starting stocks to optimize margins.

Sources: Tridge, Agravery, Agri, Graintrade, Kamu3, Oilworld, Superagronom, UkrAgroConsult

Read more relevant content

Recommended suppliers for you

What to read next