News

Original content

The combined olive oil production in six of the world's largest producing countries could reach 2.65 million metric tons (mmt) in the 2025/26 crop year according to preliminary estimates. This forecast represents a decrease from the 2.94 mmt produced in the 2024/25 season but remains above the five-year average of 2.41 mmt. The final yields are highly dependent on rainfall over the next two months. In Spain, the forecast has been revised downwards to between 1.5 and 1.55 mmt due to an exceptionally hot and dry summer, causing prices at origin to rise from their mid-summer lows. Italy anticipates a recovery to approximately 300,000 metric tons (mt), though production in the south continues to be hampered by Xylella fastidiosa. Greece expects a harvest similar to last year's at around 240,000 mt, while Turkey's output is projected to fall by half to 200,000 mt as producers enter an off-year. There are no official estimates for Tunisia yet, but conditions are similar to the previous season with yields also expected to be close to last year's 340,000 mt.

The average price of agricultural output in the European Union (EU) rose by 5.6% in the second Q2-2025 compared to the same period in 2024, confirming a return to an upward trend after a period of decline. However, this overall increase masks a significant divergence among key agricultural products. While prices for eggs (+27.8%), fruit (+21.1%), and milk (+13.3%) saw sharp rises, olive oil experienced a steep price decline of 39.9%. This occurred while the average price of agricultural inputs, such as energy and fertilizers, saw only a slight increase of 0.4%. The rise in output prices was widespread, with increases recorded in every EU country except Greece. The dramatic fall in olive oil prices stands in stark contrast to the general inflationary trend in the EU's agricultural sector, highlighting the role of the larger 2024/25 olive oil output that has driven its price correction over the past year.

The European Commission has formally approved the updated terms of the European Union-Mercosur Partnership Agreement (EMPA), advancing a deal that would create the world's largest free-trade area. For the olive oil sector, the agreement is highly significant as it aims to remove the ten percent tariff on olive oil and duties on table olives between the EU and the four Mercosur countries (Brazil, Argentina, Uruguay, and Paraguay). To address opposition from major agricultural producers such as France and Italy, the updated terms include stronger bilateral safeguards to protect sensitive European products from import surges. Crucially for olive oil producers, the agreement will also legally recognize and protect 344 European Geographical Indications (GIs), including over 130 for extra virgin olive oils, banning imitations and misleading labels in Mercosur markets. The deal now faces a complex and challenging ratification process, requiring approval from the European Council, the European Parliament, and each of the 27 member states.

The European Commission has officially approved the addition of "Κρήτη / Kriti" to its register of Protected Geographical Indications (PGI). This long-awaited designation applies to extra virgin olive oil produced exclusively from olives grown on the island of Crete. Olive oil from Crete is defined by its distinct characteristics, including low acidity, a bright green color, and a rich fruity aroma, which are attributed to the island's unique limestone soils, climate, and traditional cultivation practices. For the market, this PGI status provides a crucial international guarantee of authenticity and acts as a quality guarantee for consumers. For local producers it serves as a powerful marketing tool and a legal protection against counterfeiting and imitation in the competitive world of Mediterranean olive oil exports.

The 2025/26 olive harvest has officially commenced in Italy, with mills in southeastern Sicily beginning operations in the second week of September. The initial results are positive, providing the first tangible indicators of the new season's potential. Mills have started processing the early-ripening Moresca variety. The olives are reported to be of high quality, having avoided significant water stress or damage from the olive fruit fly. This excellent condition has resulted in average yields of around 12%. Several mills, including Frantoio Ruta, Frantoi Covato, and Frantoio Scopellato, have reported high yield outcomes. This strong start in Sicily sets a positive tone for the Italian harvest, which the market has been cautiously anticipating.

A new Italian Ministerial Decree (No. 460947/2024) requiring olive traders to deliver olives to mills within six hours of collection has sparked significant industry backlash and legal debate as the harvest begins. While the stated goal is to enhance traceability and combat fraud, the Italian Association of Olive Oil Mills (AIFO) has warned the rule is unsustainable and risks shutting down plants across half of Italy. AIFO argues the deadline is operationally impossible for mills in central and northern Italy that rely on sourcing olives from the south, and has formally proposed extending the limit to 24 hours. The ambiguity in the definition of trader, which could include growers or mills who purchase any third-party olives, has added to the uncertainty and legal perplexity in the market. Beyond these practical concerns, the decree faces constitutional challenges, with critics questioning its fairness and its impact on economic freedom. The timing is also critical, as the rule threatens the viability of mills that have recently made significant government-funded investments in modernization, creating widespread uncertainty in the sector.

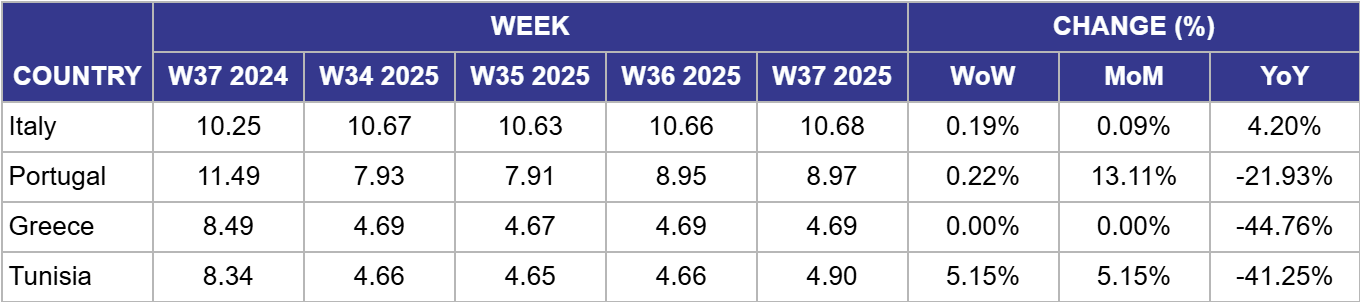

In Italy, the price of extra virgin olive oil was USD 10.68/kg in W37, up 0.19% week-on-week (WoW), up 0.09% month-on-month (MoM), and up 4.20% year-on-year (YoY). The marginal WoW and MoM increases confirm that the market remains in a stable, high-level equilibrium, with the start of the new harvest in Sicily providing a firm price floor. Early results from the Sicilian harvest show promising yields, reinforcing the premium value of the new season's oil. The sustained 4.20% YoY price premium is a direct consequence of Italy's structural production deficit and its focus on high-quality, differentiated products. Italian producers are expected to maintain this premium positioning even as supply from other Mediterranean countries grows, leveraging their strong brand reputation and limited volumes to command prices more than double those of Spanish equivalents.

In Portugal, the price of extra virgin olive oil was USD 8.97/kg in W37, up 0.22% WoW, up a significant 13.11% MoM, but down 21.93% YoY. The slight WoW change indicates short-term price stability as the market awaits the new harvest. The substantial MoM increase reflects the tail end of a late-season supply squeeze, where dwindling stocks from the previous season commanded higher prices before the market paused in anticipation of the new, large crop. The significant 21.93% YoY decline is consistent with the broader Mediterranean trend, representing a market correction from the record-high prices of the 2023/24 scarcity period. This correction is supported by the strong 2024/25 harvest and optimistic forecasts for the upcoming 2025/26 season.

In Greece, the price of extra virgin olive oil was USD 4.69/kg in W37, flat WoW and MoM, but down 44.76% YoY. The completely flat WoW and MoM figures indicate the Greek market is at a standstill, caught between the end of the old season and the beginning of the new one. With stocks from the 2024/25 campaign almost depleted, there is little to no trading activity to influence prices. The market is now in a holding pattern, awaiting the start of the new harvest, which is expected in mid-to-late October. However, underlying tension remains due to uncertainty over the final yield, as prolonged heat and dry conditions are reportedly affecting the health of olive groves. The massive YoY price drop reflects the market's fundamental reset after the strong 2024/25 harvest ended the previous year's supply crisis.

In Tunisia, the price of extra virgin olive oil was USD 4.90/kg in W37, surging 5.15% WoW and MoM, but remaining down 41.25% YoY. This sharp WoW and MoM increase signals an abrupt end to the market standstill seen in previous weeks. The price jump represents a market reset as it transitions from the dormant old season, where remaining stocks had quality issues, to the new 2025/26 campaign. This new, higher price reflects the anticipated quality of the upcoming harvest and sets the opening position for the season. It aligns with Tunisia's strategy to maintain competitive pricing in the Mediterranean, generally above Spanish averages but below Italian premiums. Despite the surge, the significant YoY decline confirms that prices are still far below the crisis levels of the previous year.

The downward revision of Spain's 2025/26 production forecast to as low as 1.5 million tons, combined with a lack of rain, signals impending supply tightness from the world's largest producer. Prices at origin in Spain have already begun to rise from their mid-summer lows in response to these declining expectations. Large-scale buyers and bottlers who rely on Spanish volume should act preemptively to secure their required inventory for the upcoming season. Waiting for the harvest to progress will likely mean competing for a smaller-than-anticipated supply pool at progressively higher prices. By entering into contracts early, buyers can lock in volumes and costs before the full impact of the reduced harvest forecast is reflected across the market, mitigating the risk of significant price inflation and supply disruption in the coming months.

The EU-Mercosur Partnership Agreement's dual benefit of removing the 10% olive oil tariff and legally protecting over 130 olive oil Geographical Indications creates a significant new export frontier for European producers. The recommended action is for producers of these GI-certified oils to proactively develop their market entry strategies for Mercosur countries now, ahead of the deal's final ratification. This involves conducting market research to identify high-potential retail and food service sectors in major cities like São Paulo and Buenos Aires, seeking out and vetting potential import and distribution partners, and preparing a marketing campaign that leverages the newly protected GI status as a guarantee of European authenticity and superior quality. By laying the groundwork before the trade barriers officially fall, European producers can establish themselves as first-movers, securing a crucial competitive advantage before the market becomes saturated once the agreement is fully implemented.

Sources: Tridge, Olive Oil Times, Olivo News, Eurostat, EFA News

Read more relevant content

Recommended suppliers for you

What to read next