Original content

1. Weekly News

Global

Global Dairy Markets Under Pressure as Structural Oversupply Overwhelms Demand

Global dairy markets are experiencing a severe and widespread downturn, with prices for butter, cheese, and milk powders all falling sharply as a structural oversupply of milk overwhelms sluggish international demand. Exceptionally high milk production is being reported across all major exporting regions, including the European Union (EU), the United States (US), and New Zealand, creating a flood of raw material into commodity processing streams. Favorable pasture conditions in Europe and a positive early-season outlook in New Zealand are contributing to this glut, while in the US, strong output continues to outpace soft domestic demand. Analysts note that the current production surge is unprecedented, and with farm-level economics still supportive of production, a quick supply-side correction is unlikely. The impact has been most dramatic in the European butter market, which has entered free-fall as ample supply meets weak demand. This bearish sentiment is echoed across the entire dairy complex, with synchronized weakness in powder markets and intense competition from low-priced US cheese exports, creating a challenging near-term outlook as the supply-demand imbalance persists.

Modest Growth Precedes Major M&A Shake-Up in Global Dairy

Rabobank's latest Global Dairy Top 20 report signals that the industry is on the verge of a significant transformation, with a wave of mergers and acquisitions (M&A) expected to reshape the competitive landscape in 2026. This forecast comes amid a period of modest growth, with the combined turnover of the top 20 companies projected to increase by only 0.5% in 2025. The current rankings show Lactalis extending its lead in the number one position with revenues of USD 31.9 billion, followed by Nestlé and Dairy Farmers of America. Rabobank anticipates major shifts driven by a series of significant deals, including the planned mergers of Arla Foods with DMK Group and FrieslandCampina with Milcobel, both set to create powerhouse European cooperatives. Additionally, the integration of Yoplait into Lactalis and Sodiaal will impact the yogurt sector, while Unilever’s divestment of its ice cream business is expected to open new spots in the rankings. This impending consolidation underscores the need for global dairy manufacturers to focus on strategic positioning, innovation, and sustainability to remain competitive in a rapidly evolving market.

Europe

Euronext Announces New Dairy Futures to Provide Hedging Tools for European Market

Euronext has announced the upcoming launch of new European Dairy Futures contracts, with trading set to begin in the Q2 2026, pending regulatory approval. The new cash-settled futures, to be listed on the Euronext Paris Commodity Derivatives market (MATIF), will be based on the prices of European butter (82%) and skimmed milk powder (SMP). The contracts are designed to provide the European dairy industry with a much-needed and long-awaited tool for price risk management and hedging. Settlement will be based on the new BMR-compliant Vesper Price Index (VPI-B), ensuring a reliable and transparent process that reflects real market conditions. The futures aim to offer dairy producers, traders, and buyers a liquid solution to protect against volatility and improve budget stability. The contracts will cover products from six key EU nations (Netherlands, Germany, France, Belgium, Denmark and Ireland) and will list 18 consecutive monthly maturities. Euronext also plans to activate American Options on Dairy Futures when sufficient liquidity is reached on the underlying futures.

Belgium

New AI Monitoring Technology of Dairy Cows Tested in Flanders

Researchers in Flanders, Belgium, are developing artificial intelligence (AI) tools to address key challenges in the dairy sector. The innovations aim to enhance animal health, welfare, and overall farm efficiency. One key development is a predictive analytics model that uses genetic and historical data to identify which calves have the greatest long-term potential as productive milk cows, allowing for more effective herd management from an early stage. A second, more advanced application involves computer vision. This system uses video cameras to recognize and monitor individual cows 24/7 without the need for physical sensors or tags. By tracking location and behavior, the AI can provide real-time alerts for issues such as lameness, illness, or abnormal activity, improving animal welfare and enabling early intervention. These technological advancements come as Flemish dairy farmers face mounting pressure from stricter environmental regulations, labor shortages, and a decline in new entrants to the industry. The AI tools are designed to act as a 24/7 digital assistant, helping to ease workloads while improving the standard of animal care. By boosting efficiency, the technology promises to help farmers cut costs, reduce emissions, and create a more sustainable and profitable future for the sector.

Netherlands

FrieslandCampina and Milcobel Announce Details of Final Merger Plan

Dutch dairy cooperative FrieslandCampina and its Belgian counterpart Milcobel have taken a significant step towards their planned merger by publishing the final proposal for the integration of the two companies, following the announcement of their intention to merge in December 2024. The proposed merger aims to create a more resilient and future-proof cooperative with the increased scale necessary to invest in innovation, productivity, and sustainability. According to the companies, the primary goal is to maximize the value of member milk, ensuring a leading milk price and providing stable, long-term income for their farmer-owners in an increasingly competitive and demanding global market. The proposal will now be presented to the members of both cooperatives for consultation throughout the autumn. A final vote on the merger is scheduled for December 16, 2025, requiring a two-thirds majority from FrieslandCampina and a three-quarters majority from Milcobel for approval.

United Kingdom

UK Milk Production Accelerates with Strong Year-on-Year Growth

Milk production in Great Britain continues to show accelerating year-on-year (YoY) growth, with daily deliveries for the week ending September 13th running 6.1% higher than the same period in 2024. Deliveries also increased by 1.0% compared to the previous week, indicating a solid production trend as the season transitions into autumn. This strong daily performance builds on the consistent growth seen throughout the summer, with the Agriculture and Horticulture Development Board (AHDB) now estimating total United Kingdom (UK) production for Aug-25 at 1,262 million litres. The sustained and accelerating increase in milk flow provides a significant volume of raw material for the UK's dairy processors, bolstering domestic supply chains and enhancing export capabilities. This ample supply is particularly noteworthy in the current global context, where a broader market downturn is being driven by oversupply, positioning UK processors competitively but also adding to the overall supply pressure in the European market.

GB Organic Milk Growth Accelerates to Double-Digit Year-on-Year Increase

Growth in Great Britain's organic milk sector has accelerated significantly, with daily deliveries for the week ending September 13th surging to 12.1% above the levels of the same period last year. This represents a sharp increase in the growth rate and is supported by a strong 5.2% rise in volumes compared to the previous week. This trend of robust expansion is further confirmed by the latest monthly estimate from the AHGB, which places total Great Britain organic production for Aug-25 at 28.0 million litres. The sustained, double-digit growth in the organic milk pool underscores a powerful combination of rising consumer demand and increased farm-level production capacity. This rapid expansion provides a substantial and growing supply of high-value raw material for processors, enabling them to confidently invest in and expand their organic dairy portfolios to capture a larger share of this high-growth consumer segment.

2. Weekly Pricing

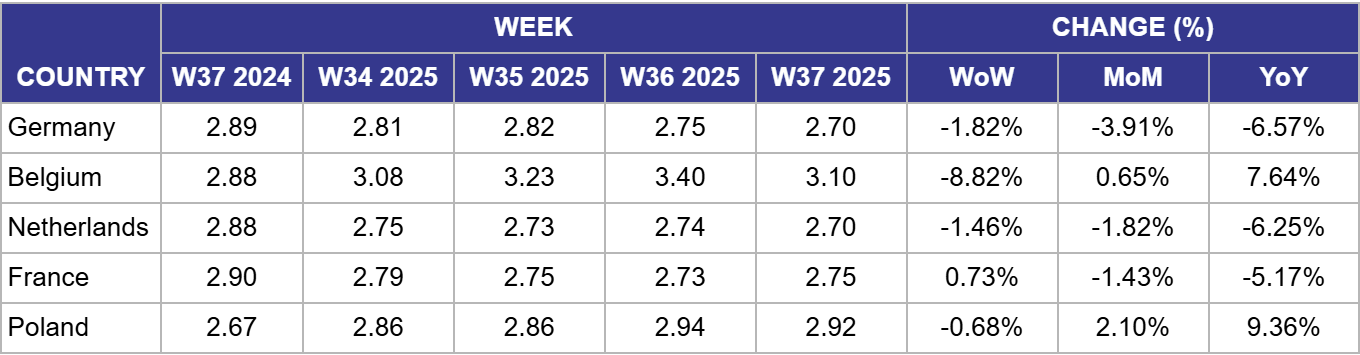

Weekly Powdered Milk Pricing Important Exporters (USD/kg)

Yearly Change in Powdered Milk Pricing Important Exporters (W37 2024 to W37 2025)

Germany

In Germany, the price of SMP was USD 2.70 per kilogram (kg) in W37, a continued decrease of 1.82% week-on-week (WoW) and 3.91% month-on-month (MoM), accelerating the decline to 6.57% YoY. The German market remains under severe bearish pressure, with prices continuing their sharp descent. This is a direct consequence of the global market plunge, with widespread reports of a structural oversupply of milk across the EU and other major exporting regions. With buyers retreating and global commodity markets described as being in a free-fall, Germany's export-sensitive market is experiencing the full force of the downturn. The accelerating negative YoY performance indicates that the global supply glut, confirmed by robust production in neighboring countries, is now the dominant price driver, overwhelming any domestic market factors.

Belgium

In Belgium, the price of SMP saw a dramatic correction to USD 3.10 per kilogram (kg) in W37, falling 8.82% WoW. Despite this drop, the price remains slightly positive at 0.65% MoM and is still up 7.64% YoY. After defying the European trend for the past two weeks, the sheer scale of the global market oversupply has finally impacted the Belgian market. The sharp WoW correction suggests that even an acute domestic supply shortage cannot insulate prices from a structural global oversupply. Buyers, aware of collapsing prices in neighboring Germany and the Netherlands, are no longer willing to pay a high premium, forcing a rapid price realignment.

Netherlands

In the Netherlands, the price of SMP was USD 2.70 per kilogram (kg) in W37, declining 1.46% WoW and 1.82% MoM, pushing the YoY comparison further down to -6.25%. The Dutch market's decline is accelerating as the powerful bearish sentiment across global dairy markets takes full effect. The structural oversupply reported across the EU and other major exporters has confirmed and intensified the weak international demand outlook that was already pressuring Dutch prices. Any price support from a slightly tighter domestic milk supply or intense processor competition has been completely overwhelmed by the global supply glut. The negative price movements across all timeframes indicate that bearish international factors are now firmly in control of the market.

France

In France, the price of SMP was USD 2.75 per kilogram (kg) in W37, showing a slight increase of 0.73% WoW, but remaining down 1.43% MoM and 5.17% YoY. The French market saw a minor WoW uptick, which is likely a technical bounce after several weeks of decline rather than a sign of fundamental strength. The broader trend remains decidedly negative, with the MoM and significant YoY declines reflecting the market's underlying weakness. The global market is currently gripped by a structural oversupply and weak demand, which is preventing any meaningful price recovery in France. The short-term disruption from the earlier Lumpy Skin Disease (LSD) outbreak has given way to the more powerful bearish pressure of the global market downturn.

Poland

In Poland, the price of SMP was USD 2.92 per kilogram (kg) in W37, a slight decrease of 0.68% WoW, but the price remains up 2.10% MoM and a strong 9.36% YoY. The Polish market's strong upward momentum has stalled, with the slight WoW dip indicating that the powerful bearish sentiment sweeping global markets is finally capping the recent rally. While strong, targeted export demand provided a temporary buffer in previous weeks, the sheer weight of the structural oversupply across Europe is now preventing further price increases. The positive MoM and YoY figures are a legacy of the market's recent strength, but the halt in the WoW trend is a key development, suggesting Poland is not entirely immune to the global price collapse.

3. Actionable Recommendations

Proactively Manage Price Risk with New Euronext Dairy Futures

Given the current market free-fall caused by a global supply glut, industry players are exposed to severe price volatility that erodes profitability. The announcement of Euronext Dairy Futures, set to launch in Q2 2026, presents a crucial opportunity for proactive risk management. Processors, exporters, and large producers should begin preparing now to utilize these financial instruments. The key action is to invest in training for procurement and finance teams to understand futures contracts, options, and hedging strategies. By learning how to use these tools before they go live, industry players can be ready to lock in prices, protect margins, and create more predictable budgets. This will provide a significant competitive advantage and a crucial layer of stability in a market defined by oversupply and intense price pressure. Waiting until the launch date will mean missing the opportunity to be a first mover in securing financial stability.

Escape the Commodity Trap by Diversifying into High-Value Niches

The current global dairy market is characterized by a structural oversupply of conventional milk, leading to plummeting prices for commodity products like SMP. To counter this, processors and producers should strategically pivot towards high-value niche markets that demonstrate strong, independent growth. The UK's organic milk sector, which is experiencing accelerated, double-digit YoY growth, is a prime example. This indicates robust consumer demand that is insulated from the pricing pressures of the conventional market. The recommendation is to conduct market analysis and invest in the capacity to produce and market premium products like organic and hybrid cheese, yogurt, and liquid milk. This diversification strategy allows companies to capture higher margins, build brand loyalty, and reduce their vulnerability to the boom-and-bust cycles of the bulk commodity market, ensuring a more sustainable and profitable future.

Sources: Tridge, AHDB, FrieslandCampina, Belga, Euronext, Foodbev, Vesper

Read more relevant content

Recommended suppliers for you

What to read next