News

Original content

The global wheat market in 2025 faces a bearish environment driven by oversupply, intense competition, and geopolitical tensions, creating significant challenges for investors and exporters. Russia continues to dominate exports, projected to ship 41.5 million metric tons (mmt) in 2025/26, while Australia leverages its access to Asia and high-quality wheat, and the United States (US) and Canada contend with domestic supply gluts and droughts. Rising production globally is offset by regional imbalances, logistical bottlenecks, and trade barriers, such as US tariffs on China and Mexico, which have diverted capital and shifted purchasing toward Russian and European Union (EU) wheat. European markets are pressured by Black Sea competition and technical corrections, with Russian wheat prices falling to between USD 228 per metric ton (mt) and USD 230/mt. Major importers like Egypt are reducing purchases due to organizational uncertainties, decreasing imports by over 27% year-on-year (YoY) in H1-2025, even as domestic demand rises. Weather conditions across Europe are mixed, alleviating drought in France and the Balkans while creating dry, hot conditions in southern Europe, affecting winter wheat and barley planting.

Japan will reduce the price of imported wheat for flour mills by 4% starting in Oct-25, marking the fifth consecutive cut, as a result of falling global wheat prices and a stronger yen. The new price of USD 414/mt (JPY 61,010/mt), down from USD 431/mt (JPY 63,570/mt), reflects stabilization in the global wheat market. Japan relies on imports for over 80% of its wheat, mainly from the US, Canada, and Australia, and adjusts prices biannually based on harvest conditions, weather risks, and shipping costs, with the yen’s appreciation further easing import expenses. This price reduction is expected to stabilize profits for flour mills and food producers, potentially lowering costs for bread and noodles, while signaling easing global food inflation that may benefit other major wheat-importing nations.

Between May-25 and Sep-25, Kazakhstan strengthened its role in grain logistics by shipping 17 thousand mt of wheat from Ak-Kul, Azat, and Kokshetau to Vietnam via China’s port of Lianyungang, using uninterrupted container transport that preserved quality, cut costs, and reduced delivery times. The project, led by Kedentransservice JSC in cooperation with Fort LLP and NC Food Contract Corporation, showcased the efficiency of Kazakhstan’s infrastructure and its potential as a Eurasian transit hub for Southeast Asia’s growing grain demand. At the same time, overall rail grain exports rose 52% YoY in the first eight months of 2025. However, despite favorable weather supporting above-average yields, wheat quality has been lower than expected, with a higher share of 4th and 5th class grain due to adverse weather during grain filling. This is creating a widening price gap between higher-and lower-quality wheat, while strong oilseed harvests are expected to balance the market outlook.

The Punjab government in Pakistan has banned the use of wheat in feed mills for 30 days, effective September 5, to ensure adequate flour supplies. Feed mills in Punjab held around 104.18 thousand mt of wheat, previously intended for poultry feed, as rising wheat and flour prices strain households. Between Aug-25 and Sep-25, wheat prices surged from USD 0.22 per kilogram (kg) to USD 0.34/kg (PKR 62/kg to PKR 97/kg), while flour reached USD 0.38/kg (PKR 108/ kg) for fine flour. The crisis is worsened by record monsoon floods in Punjab, which have destroyed crops and submerged over 2,000 villages. Prices have spiked nationwide, affecting Punjab, Sindh, and Khyber Pakhtunkhwa, and pushing inflation higher. Industry groups urge the government to allow imports and access emergency reserves to stabilize wheat and flour supplies across Pakistan.

Russia’s wheat exports in the 2025/26 season have reached 6.2 mmt so far, with nearly 4.4 mmt shipped in Aug-25 alone, led by strong sales to Egypt, Turkey, Israel, Kenya, and Saudi Arabia. Despite this activity, export volumes are significantly lower than a year ago, reflecting subdued demand amid abundant supply. Prices for Russian wheat with 12.5% protein fell to between USD 228/mt and USD 230/mt in early Sep-25, the lowest since Jul-25. This is largely due to weakening domestic prices, record harvest expectations of 86.1 mmt, and falling global benchmarks in France, the US, and the Black Sea region. While local authorities highlight stable production, market analysts warn of systemic strains in Russian agriculture. To strengthen its long-term position, Russia is also pushing infrastructure expansion, with a government-approved plan to build 17 new seaport terminals by 2036.

Ukraine’s 2025 wheat harvest is estimated at 23 mmt, with exports projected at 15 mmt and ending stocks rising to 1.93 mmt as harvesting nears completion. Food wheat prices remain under pressure from abundant global supply, whereas feed wheat is supported by tight feed grain availability and delayed corn harvesting. Domestically, processors are securing up to 7 mmt annually, building three to five months of stocks at favorable prices, particularly for high-quality wheat that earns premiums over export values. At the same time, winter sowing for the 2026 season is underway across eight regions, with rapeseed already covering more than 60% of the planned area. Grain exports since Jul-25 total 4.6 mmt, down 3.3 mmt from last year, with wheat shipments falling 25% YoY and barley and corn declining even more sharply, reflecting logistical and market constraints.

The US has started planting its 2026 winter wheat crop, with 5% of the area in major producing states already sown, keeping pace with last year but slightly behind the five-year average. Improved topsoil moisture has supported hard red winter (HRW) wheat regions, though soft wheat states remain relatively dry. Despite these favorable conditions, low wheat prices are discouraging expansion, with analysts projecting planted areas to remain flat or decline by up to 2% YoY as farmers weigh insurance and program incentives against poor market returns. Futures prices for both HRW and soft red winter (SRW) wheat are down about USD 0.75 to USD 1 per bushel YoY, reinforcing limited planting incentives. At the same time, drought still affects 34% of winter wheat acreage, especially in the Pacific Northwest. However, this is an improvement compared to last year’s more severe conditions.

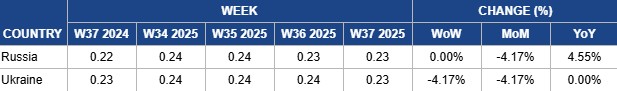

In W37, Russia’s wheat prices held steady week-on-week (WoW) at USD 0.23/kg, reflecting a 4.17% month-on-month (MoM) decline but a 4.55% YoY increase. The monthly drop mirrors a bearish outlook driven by improved harvest prospects, as Russia’s wheat production is anticipated to range between 85.5 mmt and 86 mmt in 2025/26, with potential for further upward revisions. Favorable dry and warm conditions in Central Russia and the Volga region are supporting harvest completion and winter crop sowing, while easing rainfall in Siberia and the Urals is expected to accelerate grain collection. However, the sharp rise in Russia’s wheat export duty from USD 2.03/mt (RUB 168.6/mt) to USD 5.96/mt (RUB 495.9/mt), effective from September 17, is likely to curb exports in the near term.

In W37, Ukraine’s wheat prices fell by 4.17% WoW and MoM to USD 0.23/kg, but holding steady YoY. The decline is largely influenced by lower Russian wheat prices following another upward revision in Russia’s harvest forecast. Weaker export demand also weighs on the market, with Ukraine’s wheat shipments in the first half of Sep-25 down 51% YoY at 982 thousand mt. This brings total exports in the 2025/26 season to 3.63 mmt, 45% below last year’s 5.26 mmt. Meanwhile, the Ministry of Economy, Environment and Agriculture reduced the minimum allowed export prices on September 10 to USD 0.17/kg FOB from USD 0.19/kg in Jun-25 and USD 0.160/kg carriage paid to (CPT) from USD 0.163/kg in Jun-25, adding further downward pressure.

Japanese flour mills and food producers should lock in lower wheat prices through forward contracts to stabilize margins and minimize exposure to future market volatility. Companies can invest in process efficiencies and inventory management to pass cost savings to consumers, enhancing competitiveness. Monitoring yen fluctuations and global harvest reports will allow timely adjustments to procurement strategies, ensuring continued benefits from global price trends.

Kazakh wheat exporters should capitalize on the success of uninterrupted container transport to reduce costs and preserve quality, scaling up operations to meet Southeast Asia’s growing demand. Investments in rail and port infrastructure, combined with quality improvement programs for 4th and 5th class wheat, can enhance competitiveness. Partnering with regional buyers to secure long-term contracts and leveraging logistics efficiency as a marketing advantage will strengthen Kazakhstan’s role as a Eurasian wheat transit hub.

The Pakistani government should complement the temporary feed mill ban with immediate wheat imports and activation of emergency reserves to stabilize supply and curb inflation. Coordinated inter-provincial transport policies and clear communication with millers can reduce artificial shortages. Additionally, promoting alternative feed ingredients for poultry and livestock can alleviate pressure on wheat demand, ensuring household food security during the ongoing flood recovery period.

Sources: Tridge, AgroInvestor, Superagronom, UkrAgroConsult

Read more relevant content

Recommended suppliers for you

What to read next