Original content

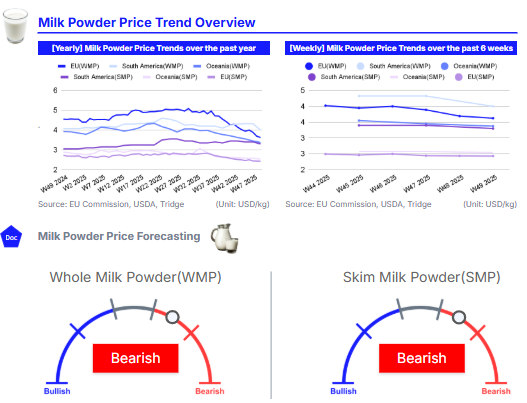

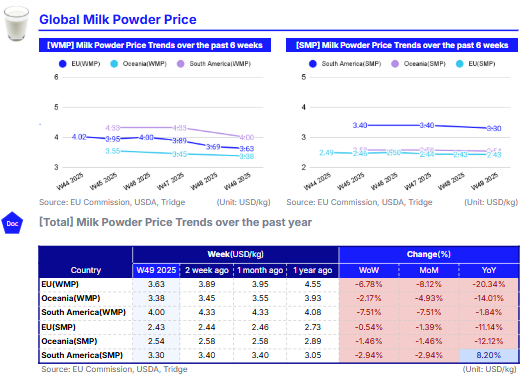

In W49, European Union (EU) whole milk powder (WMP) averaged USD 3.63 per kilogram (kg), down 6.78% week-on-week (WoW), 8.12% month-on-month (MoM), and 20.34% year-on-year (YoY). The drop was driven by sellers adjusting offers to stay competitive, while buyers limited purchases to near-term needs, providing little support for firmer values. EU WMP production remains steady on ample milk supplies, and available volumes are sufficient to meet current demand.

Similarly, Oceania WMP averaged USD 3.38/kg, down 2.17% WoW, 4.93% MoM, and 14.01% YoY, pressured by strong production and weaker export demand amid abundant global supply. In South America, WMP prices averaged USD 4.0/kg, falling 7.51% both in WoW and MoM, and down 1.84% YoY, reflecting high production and full-capacity operations.

For skim milk powder (SMP), EU prices averaged USD 2.43/kg, down 0.54% WoW, 1.39% MoM, and 11.14% YoY. Buyer activity remained cautious, focused on covering immediate needs, while production stayed steady with spot availability matching demand.

Oceanian SMP prices stood at USD 2.54/kg, declining 1.46% both in WoW and MoM, and 12.12% YoY, driven by strong production and abundant milk for drying, with export prices easing moderately. In South America, SMP averaged USD 3.30/kg, down 2.94% WoW and MoM, but up 8.20% YoY, reflecting ample milk supplies and producers operating at full capacity.

According to the Food and Agriculture Organization (FAO), the global dairy price index averaged 137.47 points in Nov-25, reflecting a 3.12% MoM decline. The drop was largely driven by weakening prices across major dairy commodities, fueled by rising milk production and abundant export supplies in key producing regions. Milk powders were particularly affected, with the WMP index averaging 123.65 points, down 5.64% MoM, and the SMP index falling 2.64% MoM to 97.81 points. Increased export availability and stronger competition weighed on WMP prices, while SMP prices eased amid ample supplies and limited buying interest.

This pattern was mirrored in the Global Dairy Trade (GDT) auction held on December 2, where the overall dairy index dropped 4.3% to USD 3,507 per metric ton (mt) compared to the previous event. In particular, WMP prices fell 2.4% to USD 3,364/mt, while SMP declined 1.6% to USD 2,498/mt compared to the previous auction. North Asia, the Middle East, and Southeast Asia/Oceania were the primary buyer participants.

From a production perspective, the United States Department of Agriculture (USDA) forecasts EU WMP output to reach 590 thousand mt in 2026, marking a 1.7% YoY decline. This reduction is attributed to processors prioritizing cheese production over WMP, as milk powder generally generates lower processing margins compared to cheese, which offers more stable long-term returns.

In South America, milk powder markets remained under pressure due to abundant regional milk supplies combined with strong global and US milk production. This situation reinforced downward price trends and compressed producer returns.

Given the ample milk supply and steady production of WMP and SMP amid declining prices, EU producers should prioritize optimizing production and inventory management to prevent oversupply. Shifting part of milk output toward higher-margin products, such as cheese or specialty dairy, can help maintain profitability. Expanding targeted exports to high-demand regions in Asia and the Near East, where buying activity remains firm, will help stabilize prices. Additionally, promoting value-added or fortified milk powders can differentiate offerings and capture higher margins in both domestic and export markets.

Oceania stakeholders should continue to strengthen ties with key export markets, particularly in North Asia, the Middle East, and South Asia, where demand is relatively robust. Entering into long-term supply contracts can ensure more stable pricing and reduce volatility. Investments in logistics efficiency and supply chain optimization will also help maintain competitiveness in global markets. Diversifying product offerings, including specialty or blended powders, may provide additional revenue streams amid softer commodity prices.

South American producers should focus on aligning production schedules with market demand to avoid excess supply, particularly in Argentina, Brazil, and Uruguay. Enhancing export capabilities, including identifying new markets and improving product competitiveness through quality certifications, will help absorb excess production.

Read more relevant content

Recommended suppliers for you

What to read next