News

Original content

Between July 1 and July 27, 2025, the European Union (EU) imported 141,500 metric tons (mt) of sunflower oil, an 18% decline compared to the same period last season. Despite the overall 38% drop in total vegetable oil imports, sunflower oil remains the leading import, followed by palm oil and soybean oil. Ukraine continues to be the primary supplier of sunflower oil for the EU, accounting for 168,200 mt, while soybean oil imports from Ukraine increased significantly. The decline in sunflower oil imports may reflect slower demand or improved domestic availability early in the season.

The sunflower harvest in Bulgaria’s Yambol region has begun, with yields well below expectations, averaging around 100 kilograms (kg) per hectare (ha) in some areas, which is insufficient to cover production costs. Early-sown crops suffered from prolonged heat during the seed-filling stage, while later-sown fields fared slightly better due to late Jul-25 rainfall. Despite modest improvements over 2024's extremely poor harvest, overall output and quality remain low. Farmers face additional pressure from weak local procurement prices of approximately USD 0.48/kg (BGN 0.80/kg), which are significantly below break-even levels. However, the impact on sunflower oil prices is expected to be minimal, as Bulgaria’s domestic supply remains sufficient and international markets, particularly Rotterdam, largely influence prices.

Kazakhstan has significantly expanded its sunflower production and oilseed sector in recent years, driven by economic viability, agroclimatic shifts, and strong government support, according to the United States Department of Agriculture's (USDA) Foreign Agricultural Service (FAS). Sunflower yields increased from 0.8 mt/ha in 2014 to 1.5 mt/ha in 2024, supported by improved seed varieties and modern farming practices. Government subsidies of USD 40.94/mt (KZT 22,000/mt) and investment in processing infrastructure have further encouraged the shift. Processing capacity is expected to double to 600,000 mt by 2025, with sunflower oil production rising from 180,000 mt in 2014/15 to over 560,000 mt in 2023/24. Exports of sunflower oil and meal surpassed 1 million metric tons (mmt) in 2023/24, a fivefold increase over the past decade, with further growth anticipated.

The Russian government has suspended floating export duties on sunflower oil and meal until August 31, 2025, aiming to boost foreign shipments and support domestic producers and processors. Previously, duties were set at USD 89/mt (RUB 7,119.8/mt) for sunflower oil and USD 13.18/mt (RUB 1,054.4/mt) for sunflower meal in Jul-25. With domestic supply fully covered, the measure is not expected to affect local availability. Analysts anticipate increased export volumes and competitiveness, particularly in Asian markets, as exporters adopt more flexible pricing strategies. The policy is expected to stimulate processor demand and enhance Russia’s presence in global sunflower oil and meal markets.

.png)

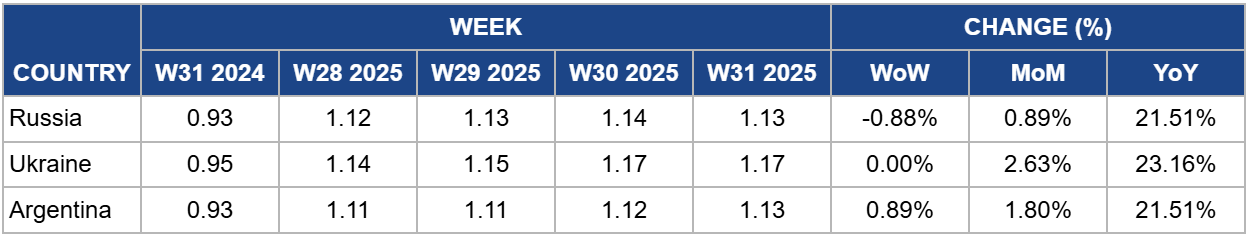

In W31, Russia's sunflower oil prices declined by 0.88% week-on-week (WoW) to USD 1.13/kg but remained 21.51% higher year-on-year (YoY) from USD 0.93/kg in W31 2024. The recent suspension of export duties on sunflower oil and meal until August 31, 2025, is expected to enhance Russia's competitiveness in global markets, particularly in Asia. While domestic supply remains stable, the policy may drive higher export volumes and processor demand, potentially stabilizing or supporting prices in the near term despite the weekly dip. If external demand strengthens, further upward price pressure may follow ahead of the new harvest.

Ukraine's sunflower oil prices held steady at USD 1.17/kg in W31, showing no WoW change but marking a 23.16% increase YoY from USD 0.95/kg. The price stability follows a recent USD 25/mt rise in sunflower oil values, which supported higher procurement prices for sunflower seeds, reaching up to USD 649.02/mt (UAH 27,000/mt) Carriage Paid To (CPT). However, lower-priced offers around USD 620.17/mt (UAH 25,800/mt) drew limited farmer interest, as some shifted focus to rapeseed sales. Declining processing activity has tightened sunflower meal supply, potentially raising input costs for feed producers. If domestic oilseed supply remains constrained, sunflower oil prices may face upward pressure in the near term.

Argentina's sunflower oil prices rose by 0.89% WoW to USD 1.13/kg in W31, marking a 21.51% YoY increase. The steady upward trend is underpinned by strong international demand, tight global stock levels, and favorable domestic conditions. Driven by improved input-output ratios, resilient international prices, and positive weather patterns, sunflower planting in Argentina is projected to reach 2.6 million ha in 2025/26, the second-largest on record.

This expansion signals a recovery for the crop, especially in Northern regions, where favorable soil moisture and economic viability are renewing producer interest. However, climatic uncertainty remains a risk, particularly in southern regions awaiting planting decisions. Despite a slight softening in global prices over the past three months due to expectations of a strong Black Sea harvest, structural supply constraints and growing biofuel demand continue to support the market. If weather conditions remain favorable, Argentina's sunflower oil output and export potential could increase, adding moderate downward pressure to prices in the medium term due to higher supply.

Producers and exporters, particularly in Russia and Kazakhstan, should leverage the current suspension of Russian export duties and government support in Kazakhstan to increase market share in key regions such as Asia. Flexible pricing strategies and expanded export volumes can strengthen global positioning amid fluctuating demand and rising competition.

Stakeholders in Bulgaria and similar markets should prioritize agronomic interventions to mitigate heat stress impacts and improve yields. Introducing heat-tolerant seed varieties, promoting efficient irrigation, and providing financial support or price stabilization mechanisms can help producers cover costs and sustain production despite adverse weather.

Importers and processors should closely track regional supply shifts, such as tightening sunflower meal supplies in Ukraine and planting expansions in Argentina and Kazakhstan, to adjust procurement and inventory strategies. Anticipating price pressures from constrained supplies or expanding production will support better risk management and optimized sourcing decisions.

Sources: Tridge, Sinor, Agravery, Ukr AgroConsult, Agrosektor, Specagro, Meteored

Read more relevant content

Recommended suppliers for you

What to read next