News

Original content

As of July 9, Brazil’s coffee harvest reached 69% completion, up 9 percentage points from the previous week and outpacing both last year's pace and the five‑year average, driven by accelerating dry-weather harvesting in Minas Gerais and Espírito Santo. Meanwhile, Brazil's National Supply Company (Conab) has raised its 2025 output forecast to 55.7 million 60-kilogram (kg) bags, a 2.7% year-on-year (YoY) rise, despite acknowledging a small contraction in Arabica area, reflecting strong productivity gains, especially in Robusta zones.

A looming 50% United States (US) tariff on Brazilian coffee, scheduled for August 6, triggered short-term volatility and has prompted Brazil to pivot toward new markets, such as China. China has granted access to 183 Brazilian coffee exporters beginning July 30, opening an important trade corridor amid growing domestic demand in China (roughly +20% annually). Analysts expect shipment routes through Panama or Mexico to minimize tariff impact while preserving price competitiveness.

Projections from the United States Department of Agriculture (USDA) anticipate a 5.3% YoY decline in Colombia’s coffee output, down to 12.5 million 60-kg bags in 2025/26, due to excessive rainfall disrupting flowering and discouraging replanting amid high price disincentives. Fortunately, first-quarter growth surged 36% in output versus 2024 levels, driven by better weather conditions earlier in the year, though sustainability concerns persist.

As midsize growers face production and environmental pressures, Colombia’s coffee sector is increasingly adopting climate-smart agricultural practices that enhance biodiversity and mitigate climate effects, positioning it as a global model for sustainable production. Techniques such as agroforestry and native tree intercropping are being supported through policy incentives and public-private initiatives to safeguard future yields.

Vietnam generated USD 5.45 billion from 953,900 metric tons (mt) of coffee exported by mid-2025, a 5.3% YoY increase in volume and a significant 67.5% YoY gain in export value. This is propelled by record Free-on-Board (FOB) prices averaging USD 5,708/mt. The government now targets USD 7.5 billion in export revenue by the end of 2025, as rising demand from Europe and North America offsets volume constraints.

Central Highlands green bean prices reversed in late May-25, falling USD 0.10-0.13/kg (VND 2,500–3,300/kg) to around USD 4.65/kg (VND 122,000/kg), as harvest influx increased supply and speculative bids eased. With 2025/26 output forecast to reach 31 million bags, strong domestic pricing may prove unsustainable unless strategic management of export flows and milling infrastructure continues to evolve.

.png)

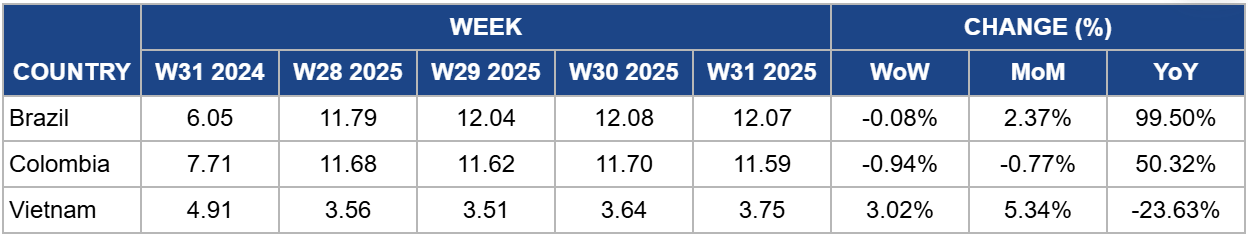

In W31, domestic wholesale green coffee prices in Brazil remained stable at USD 12.07/kg, down 0.08% week-on-week (WoW) and up 2.37% month-on-month (MoM), holding steady despite a sharp decline in international futures (around –5%) due to accelerating local harvest volumes and abundant supply availability. While the Center for Advanced Studies on Applied Economics (CEPEA) indicators show localized price dips in Robusta growing regions, broader market dynamics remain muted relative to global price shifts.

In W32, market players should expect Brazilian wholesale prices to remain stable unless harvest logistics slow or localized quality issues emerge. Any meaningful uptick in global futures or unfavorable export logistics could offer modest support. Otherwise, domestic price stability is likely given ample supply and steady demand.

In W31, Colombian wholesale green coffee was priced at USD 11.59/kg, down 0.94% WoW and 0.77% MoM. This stability is supported by favorable harvest timing and a depreciating peso, effectively boosting exporter returns in Customs of the Port (COP) terms. Although Intercontinental Exchange (ICE) Arabica futures eased slightly this week, premium origin differentials remain intact for selected grades.

Prices are expected to remain stable in W32, with minor upward potential if peso weakness continues or supply tightens during harvest. However, risk to global demand remains, and premium erosion could cap further upside unless quality segmentation plays a stronger role in buyer behavior.

In W31, Vietnamese coffee prices rose slightly by 3.02% WoW, reaching USD 3.75. Despite this weekly upward movement, YoY prices continue to decline, dropping by 23.63%, reflecting easing speculative demand and increased harvest volumes. Price movement remained modest despite international futures trending downward, as farmers' hesitancy and forward contract execution shaped supply flows.

Wholesale prices are likely to remain stable in W32, unless new export contracts are signed in bulk or weather concerns emerge. Key triggers include shifts in ICE Robusta futures and exchange-rate fluctuations, which together may influence domestic positioning or price risk perceptions.

With domestic coffee prices in Brazil, Colombia, and Vietnam showing signs of either softness or modest recovery, industry players, particularly cooperatives and producer groups, should prioritize improvements in storage infrastructure. Enhancing the ability to hold stocks during low-price periods allows producers to time the market more effectively, selling during seasonal demand spikes or international price rallies. In Brazil, this strategy is especially relevant as price stagnation is linked to ample availability and slow domestic trade. Extended storage also opens up opportunities to service forward contracts or respond to shifts in exchange rates.

Colombian producers facing a depreciating peso and downward trending prices in the domestic market should actively seek access to premium specialty channels. Investments in certification, processing quality, and marketing traceability can unlock better pricing, especially from roasters in Europe and North America that continue to demand high-quality, origin-traceable beans. Similarly, Vietnamese producers can look to expand value chains through Robusta-to-specialty conversions, especially as Robusta prices remain more resilient than Arabica in the global market. In both countries, government-backed initiatives and public-private partnerships can support farmers transitioning into these higher-margin opportunities.

The interplay between domestic currency movements and coffee prices has been especially pronounced in Colombia and Vietnam. Colombian exporters have seen some relief from peso depreciation, but this can quickly reverse. Vietnamese exporters, meanwhile, face uncertainty due to the weakening dong. Exporters and processors should utilize currency risk mitigation tools, such as forward contracts or natural hedging through invoice matching, to preserve margins. Adopting dynamic pricing strategies that incorporate real-time foreign currency exchange and futures data can help manage both cost and revenue expectations in an increasingly unpredictable macro environment.

Sources: Tridge, Malaysia Sun, ASEM Connect, StoneX, Colombian Coffee Growers Federation, Reuters, Ellers Coffee, Vietnamese Ministry of Culture, Sport and Tourism

Read more relevant content

Recommended suppliers for you

What to read next