News

Original content

In Colombia's traditional coffee-growing regions such as Caldas, Risaralda, Quindío, and Tolima, climate change is driving a significant shift from coffee to cacao cultivation, particularly among small-scale farmers. Rising temperatures, increased pest pressure, and declining yields have made coffee more difficult and costly to manage, prompting many producers to relocate crops to higher altitudes or replace them with cacao. While Colombia's coffee production has benefited from improved resistant varieties and a recent price spike due to external factors, the overall cultivation area has declined by about 100,000 hectares (ha) over the past decade. In contrast, cacao offers greater climate resilience, lower input costs, and market stability—factors that are increasingly becoming attractive to coffee farmers. This trend signals a structural transformation in Colombia's coffee belt, raising questions about the long-term viability of coffee under worsening climate conditions.

Climate change is significantly impacting coffee production in Colombia, the world's third-largest producer. Erratic weather patterns, such as fluctuating cycles of La Niña and El Niño, have led to disrupted harvests, pest outbreaks, and the spread of diseases like coffee leaf rust. In response, the National Federation of Coffee Growers (FEDECAFE) and researchers at the National Coffee Research Center (Cenicafé) have developed disease-resistant coffee varieties, including Castillo 2.0, resistant to coffee leaf rust (Hemileia vastatrix) a devastating fungal disease that has significantly impacted coffee production across Latin America, to help farmers cope. Some producers are also reverting to traditional farming methods, reintroducing shade trees and cultivating non-hybrid varieties, despite the risks of reduced yields. As climate-related challenges intensify, Colombian farmers must balance scientific innovation with sustainable practices to safeguard the future of their coffee industry.

Mexico, the world's eleventh-largest coffee exporter, aims to strengthen its coffee industry by 2025. In 2022, the country produced over 1 million metric tons (mmt) of coffee, with exports reaching 127,817 metric tons (mt), valued at USD 714 million—an increase of 16.9% from the previous year. Chile is the top importer of Mexico's unroasted coffee, while Brazil is the largest market overall. Despite the growth in exports, Mexico faces challenges such as price volatility, climate change, and pests. The Mexican government and coffee industry are working to enhance competitiveness, including promoting coffee with Denomination of Origin (DO), a certification that identifies a product as originating from a specific region, to elevate its international standing. As the industry continues to grow, Mexico seeks to diversify markets and strengthen trade ties, particularly within Latin America.

Once a leading coffee producer, Nigeria is seeing renewed interest in its specialty coffee sector despite challenges. The country's coffee production, which peaked in the 1960s, has declined due to factors such as global price fluctuations, and inefficient farming practices. However, recent efforts by small-scale producers and government initiatives aim to revitalize the sector, focusing on high-quality coffee for the growing global specialty market. While Robusta dominates Nigeria's coffee production, Nigeria's potential in the specialty coffee market remains largely untapped. Investments in infrastructure, training, and quality control are essential for unlocking the country’s full coffee potential, which could position Nigeria as a unique origin within the competitive coffee market.

Peru's agricultural export sector, including coffee, remains alert amid potential United States (US) tariff measures under the new administration. The executive director (CEO) of Cultivida, a non-profit civil association representing the Crop Science Industry in Peru (SGS), stressed the importance of preserving trade relations with the US—currently the destination for 34% of Peru's agricultural exports, including coffee, fruits, and other products. While Peru is diversifying exports to 120 countries, including growing markets in Asia and the Middle East, the CEO emphasized the need for proactive dialogue with US counterparts.

He also highlighted ongoing challenges such as inadequate water infrastructure and the need for climate resilience measures, warning that deteriorating dam capacity—like that in Poechos—could hinder agricultural productivity. In addition, he called for coordinated public-private investment in sustainable infrastructure to ensure long-term competitiveness in global markets.

The US faces rising coffee prices following the announcement of new tariffs on major coffee exporters—Brazil, Colombia, and Vietnam. These tariffs, including a 10% levy on Arabica beans from Brazil and Colombia and 46% on Robusta beans from Vietnam, come amid already elevated global coffee prices due to poor weather in key growing regions. Analysts warn that the cost increases will be passed on to US consumers, as the country imports nearly all of its coffee and produces only 0.2% of what it consumes. The tariffs are expected to reduce demand without boosting domestic production.

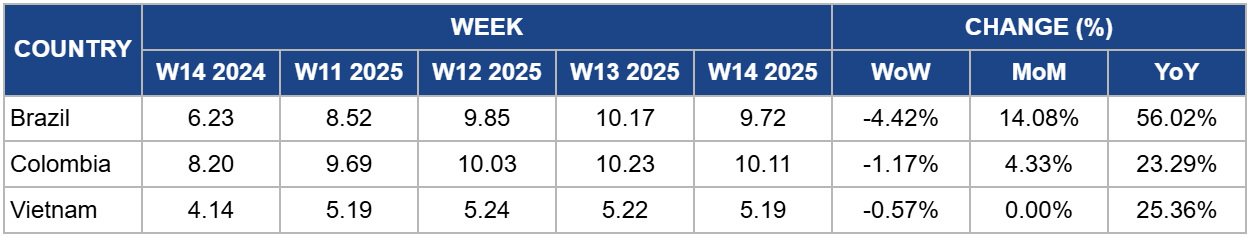

Brazil's coffee prices decreased to USD 9.72 per kilogram (kg) in W14, reflecting a 4.42% week-on-week (WoW) drop but a significant 56.02% year-on-year (YoY) increase. The weekly decline is linked to market adjustments and fluctuations in global coffee demand and supply. The yearly rise is tied to reduced coffee harvests, driven by adverse weather conditions like droughts and frosts since 2021. The National Supply Company (CONAB) forecasts a 4.4% YoY decline in the 2025 harvest, raising concerns about a supply shortage, particularly for Arabica coffee.

Prices are expected to remain elevated in the short term, with the Brazilian Coffee Industry Association (ABIC) predicting prices above USD 4 per pound (lb), though stabilization is anticipated by 2026 if conditions improve. Additionally, the US-imposed 10% tariff on Brazilian coffee exports adds uncertainty, while the tariff could offer Brazil a competitive edge over rivals like Vietnam, any potential disruption in the US-Brazil trade relationship could either lead to downward pressure on prices if demand drops or maintain elevated prices if demand remains robust.

In W14, Colombia's coffee prices dropped to USD 10.11/kg, reflecting a 1.17% weekly decline and a 23.29% YoY increase. The weekly drop is primarily due to short-term market fluctuations amid global economic uncertainties. Although Colombia was largely spared from the worst of the new US tariffs, broader trade tensions could still impact its coffee exports, especially regarding currency stability and investor confidence. The US remains Colombia’s largest export market, and while the 10% tariff on Colombian coffee is lower than those in countries like Vietnam and Indonesia, the risk of reduced demand and price pressures remains. Additionally, increased competition in the US market from other coffee exporters could create both challenges and opportunities for Colombia.

Despite these risks, the Colombian Coffee Growers Federation (FNC) remains cautiously optimistic. Strong US demand for Arabica coffee may help stabilize the market, though tariff-induced price increases could affect consumer behavior and demand for specialty coffees. If Colombia can adapt to these changes and add more value to its exports, it may find new opportunities, though these remain uncertain for now.

Vietnam's coffee prices dropped to USD 5.19/kg in W14, reflecting a slight 0.57% WoW decrease from USD 5.22/kg, but a 25.36% YoY increase. This weekly decline is attributed to short-term market fluctuations. However, the yearly price increase is driven by a significant reduction in Robusta production due to dry weather, leading to the lowest output in 25 years, along with strong export demand, particularly from Europe and the US. The combination of limited domestic supply, farmers withholding stocks, and a tightening global market has pushed prices higher, despite a decline in export volumes.

Furthermore, the imposition of a 46% US tariff on Vietnamese coffee poses a significant risk, potentially creating price gaps with competitors like Brazil and reducing demand. While this could affect the US market, Vietnam's strong presence in other markets, such as Europe and Asia, provides some buffer. If global prices continue to rise, Vietnam’s coffee sector may still achieve record export values in 2025, though the tariff’s impact remains a key risk factor.

To mitigate the impact of climate change, coffee producers in Colombia and Mexico should further invest in sustainable farming practices and adopt innovative, climate-resilient coffee varieties such as Caturra, Oasis, and Sarchimor. Collaboration with research centers and investment in farmer education will be essential for improving yields and managing pests. This approach will help maintain competitiveness and long-term stability in the coffee industry despite climate challenges.

Coffee-exporting countries like Mexico and Peru should focus on diversifying their export markets, particularly in Asia and the Middle East, to reduce dependence on the US market. Proactively engaging in trade negotiations and promoting unique coffee certifications, such as DO, can enhance their market position and resilience to external tariffs and price volatility.

Countries like Nigeria and Peru should prioritize investments in coffee production infrastructure, including irrigation systems, pest management, and quality control facilities. Improving infrastructure will increase productivity and reduce the risk of market fluctuations, ensuring that coffee exports remain competitive in the global specialty coffee market.

Sources: Tridge, Agraria, Mongabay, Financial Times, Perfect Daily Grind, DF Sub, Forbes, BNamericas, Infobae, The Pinnacle Gazette

Read more relevant content

Recommended suppliers for you

What to read next