Original content

India's rice exports have significantly surpassed 2023/24's figures, with 19.87 million metric tons (mmt) exported as of March 25, 2025, compared to 16.34 mmt in the entire 2023/24 fiscal year. The breakdown of the exports shows that basmati rice shipments reached 5.94 mmt, parboiled rice amounted to 9.04 mmt, non-basmati white rice totaled 3.32 mmt, and broken rice was 800 thousand metric tons (mt). Other rice varieties made up the remaining 760 thousand mt. The government closely monitors production, availability, and agricultural commodities trade, implementing policy interventions to ensure food security and balance the interests of consumers, farmers, and industry. Moreover, India produces around 5 to 6 mmt of broken rice annually.

Pakistan's rice export sector is facing challenges in expanding its exports to the Gulf region due to visa restrictions, high interest rates, and pricing issues. The exporters' ability to meet with potential buyers is hindered by travel limitations imposed by countries like the United Arab Emirates (UAE), Qatar, and Saudi Arabia. Moreover, the lack of affordable financing makes it difficult for exporters to remain competitive, especially with countries like India, which offer lower-priced rice. Pakistani exporters need cheaper loans and reduced policy rates to overcome this barrier.

Favorable weather conditions and government support will boost rice production in the Philippines for the 2025/26 season, according to the United States Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS). Milled rice production will increase by 2.1% year-on-year (YoY) to 12.25 mmt, with the planted area growing by 2.2% YoY to 4.7 million hectares (ha). The Rice Competitiveness Fund, initially set to end in 2024, will now expand its funding from USD 180 million to USD 530 million by 2031, continuing to support production growth. From 2019 to 2024, rice production rose from 18.62 mmt to 20.04 mmt under the program. As a result of this increased production, rice imports will decrease by 1.9% YoY to 5.2 mmt.

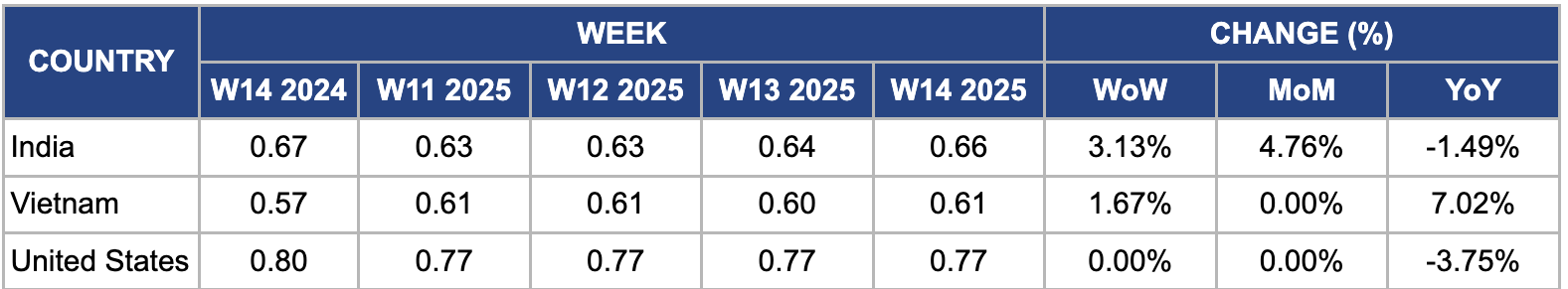

In W14, India's wholesale rice prices increased by 3.13% week-on-week (WoW) and 4.76% month-on-month (MoM) due to several key factors reaching USD 0.66 per kilogram (kg). These included reduced domestic supply due to a smaller-than-expected 2024 Rabi harvest, impacted by unseasonably dry conditions in major rice-producing regions like Uttar Pradesh and Punjab. Moreover, strong export demand, particularly from Bangladesh and African countries, coupled with higher global rice prices, added upward pressure on Indian prices. The depreciation of the Indian rupee (INR) also contributed by making Indian rice more attractive in international markets, further fueling the price increase.

In W14, Vietnamese rice prices increased by 1.67% WoW to USD 0.61/kg, driven by supply and demand dynamics. Rice prices remained high due to steady domestic and international demand, particularly from key markets like China and the Philippines. However, in Kiên Giang, one of Vietnam’s major rice-producing regions, rice supplies became limited as the ongoing harvests faced challenges such as unfavorable weather conditions and logistical delays. As a result, farmers' prices for rice varied based on quality, and transaction volumes slowed as sellers held back stocks in anticipation of higher prices. Furthermore, the limited availability in key growing areas and strong demand from the domestic market and exporters created upward pressure on prices.

In W14, United States (US) rice prices remained stable WoW but declined 3.75% YoY to USD 0.77/kg. The YoY decline was primarily driven by higher production levels in the 2024/25 crop year, with total US rice production estimated at approximately 8.6 mmt, a 3% YoY increase compared to the previous year. This increased production boosted domestic supply and alleviated price pressures. Moreover, a drop in global rice prices, especially from major exporters like India and Thailand, led to more competitive pricing on the international market, making US rice less attractive. While domestic demand remained steady, the drop in export opportunities and lower global prices contributed to the YoY price decrease.

To overcome challenges and boost rice export potential in the Gulf market despite logistical and financial constraints. Pakistan's rice exporters should explore alternatives to overcome travel and financing challenges. One strategy could be to forge partnerships with logistics providers to streamline export routes to the Gulf, potentially through digital trade platforms and online buyer-supplier matchmaking services. Moreover, exploring government-supported financing options, such as subsidized export credit lines or collaborations with international financial institutions, could help reduce the burden of high interest rates. By improving market access and affordability, Pakistan can enhance its rice competitiveness in the Gulf region, potentially increasing market share and stabilizing export volumes despite the challenges posed by higher interest rates and travel restrictions.

To capitalize on India's strong export demand and currency depreciation to increase market penetration and profitability. Indian exporters can take advantage of the depreciating rupee and rising global demand by focusing on emerging markets like Africa and Southeast Asia, where demand for rice is increasing. India could also increase its rice exports to Bangladesh, which remains a key buyer. Additionally, exporters can diversify their product range by offering different rice varieties (e.g., basmati, non-basmati, broken rice) to cater to various market segments. This approach will help India increase its export volume, strengthen its market position in diverse regions, and maintain export growth by meeting differentiated consumer preferences while benefiting from the currency's depreciation and higher global prices.

To enhance rice production efficiency and reduce dependence on imports, the Philippines should prioritize investments in modern farming technologies, such as precision farming tools and drought-resistant rice varieties. Offering subsidies to smallholder farmers would facilitate access to modern irrigation systems and essential farming inputs, key drivers for improving yields. Moreover, government-supported cooperatives can help promote collective farming, boosting productivity and market access. Strengthening storage infrastructure is also crucial to minimize post-harvest losses and ensure surplus rice is available for export. These strategies will reduce the country’s reliance on rice imports and improve its competitiveness in regional rice markets, especially in Southeast Asia and the Middle East. This comprehensive approach will enhance food security and stimulate economic growth through increased export potential.

Sources: Tridge, AgroInfo.vn, UkrAgroConsult

Read more relevant content

Recommended suppliers for you

What to read next