Original content

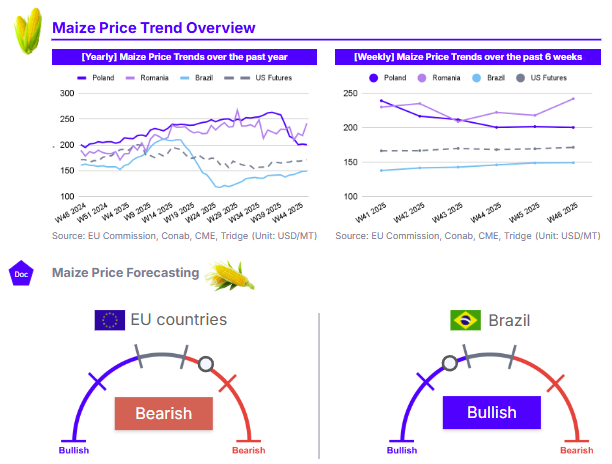

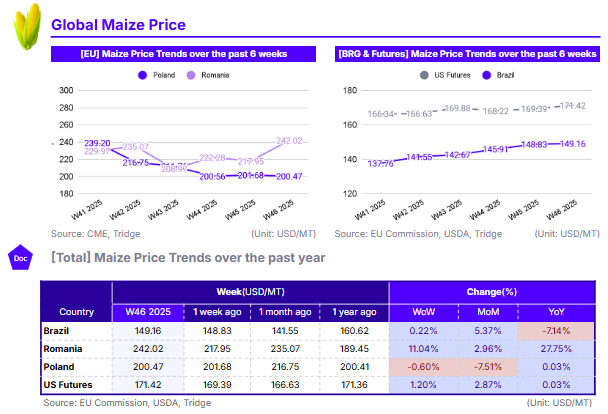

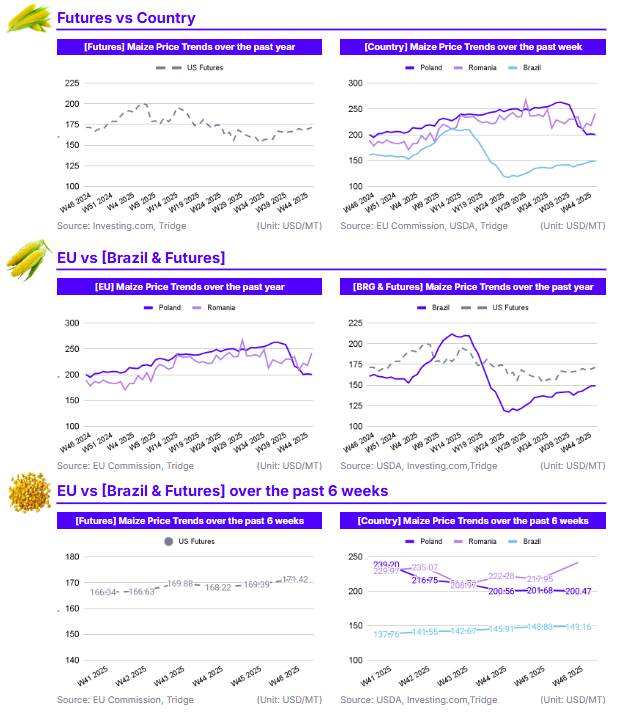

In W46 of 2025, the price of maize was USD 242.02 per metric ton (mt) in Romania, a sharp 11.04% increase week-on-week (WoW). US Futures rose 1.20% WoW to USD 171.42/mt. Brazil's price also saw a slight gain, up 0.22% WoW to USD 149.16/mt. Poland remained relatively stable, declining marginally by 0.60% WoW to USD 200.47/mt.

The dominant weekly trend is the extreme price surge in Romania, driven by acute and sustained supply concerns. The effects of the summer drought and October rains are intensifying, with production expected to be near a record low. In contrast, Poland's near-flat price reflects that the large downward price correction seen in recent weeks has stabilized, as its large crop of an estimated 9 million metric tons (mmt) has largely entered the market, with the market already pricing in the increased supplies.

The 1.20% WoW rise in the US market is a direct reaction to the newly released November WASDE report. The report revised US corn yields and overall production downward, despite the market already expecting a crop. This reduction helped to elevate the price floor by tempering bearish sentiment. Brazil's modest 0.22% WoW gain occurred even as planting progresses ahead of last year's pace (60% complete). This continuous upward movement is primarily supported by the nation's strong export performance and domestic demand for ethanol production.

In Romania, maize prices stand at USD 242.02/mt, reflecting a 2.96% increase month-on-month (MoM) which translates to a powerful 27.75% gain year-on-year (YoY). The US Futures price is up 2.87% MoM to USD 171.42/mt, stabilizing to a 0.03% YoY gain. Brazil’s price increased 5.37% MoM to USD 149.16/mt, despite remaining 7.14% lower YoY. Poland continued its downward trend, falling 7.51% MoM to USD 200.47/mt, resulting in a minimal 0.03% YoY increase.

The 27.75% YoY surge in Romania is the most dramatic long-term signal, stemming directly from the severe 32.46% production deficit compared to the five-year average. This highlights a sustained, structural supply problem relative to the previous year. Conversely, Poland's price is now nearly flat YoY (0.03% gain) and fell 7.51% MoM, marking the full absorption of pressure from its large 9 mmt harvest hitting the market.

The MoM gains in both the US and Brazil (2.87% and 5.37% respectively) are reflective of a stronger demand environment. The US rally is driven by the November WASDE report revising yields downward, along with rising exports (up 100 million bushels to 3.1 billion bushels). Brazil’s rally is sustained by strong international demand, especially from Asia and Europe, and rapidly increasing domestic demand from its corn ethanol sector, helping the market absorb the impact of a 20.9% YoY production increase in 2024/25.

European buyers and importers seeking to secure maize within the EU should prioritize Poland as a primary sourcing origin. This recommendation is driven by Poland's confirmed strong 2025 harvest, which contrasts with lower production in some Western EU countries. Favorable weather has resulted in a large Polish harvest, estimated at 9 mmt, which is 8.49% above the five-year average. The market correction seen in prior weeks has largely concluded, with the W46 price stabilizing at USD 200.47/mt, confirming a low-price floor has been established. This makes Poland a highly cost-effective origin, especially when compared to its regional competitor, Romania, where drought-reduced supplies have driven prices up 27.75% YoY. Poland has solidified its position as a major producer and exporter in the EU, and its price competitiveness and ample harvest present a clear procurement opportunity.

Global importers needing to secure large-volume contracts should focus on the US as the primary procurement destination. The fundamental driver for this strategy is the large 2025/26 crop, though the November WASDE report tightened the outlook. The official forecast revised US corn production downward, though it remains large at 426.72 mmt (16.8 billion bushels) and raised exports to a record 78.74 mmt (3.1 billion bushels). This immense supply, coupled with record export demand, has pushed the season-average farm price forecast higher. The US market offers exceptional liquidity with the harvest nearly complete, ensuring readily available physical supply. This large supply volume has anchored US prices, making it a reliable and stable source for large-volume procurement. The US market’s inherent stability and supply assurance are evident in the current futures price of USD 171.42/mt, which remains highly competitive on the global stage.

Read more relevant content

Recommended suppliers for you

What to read next