Original content

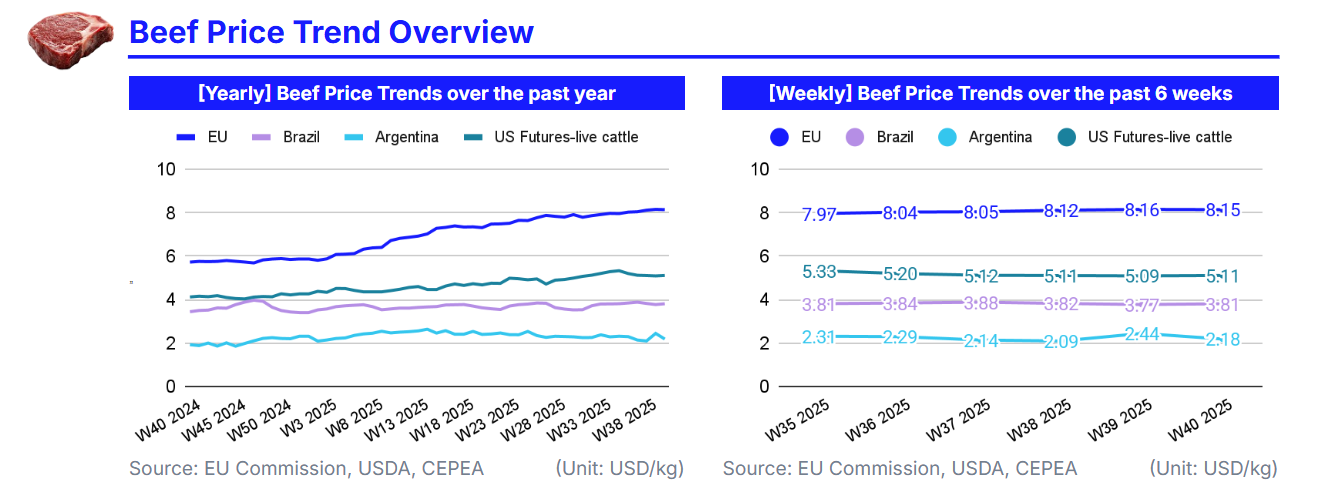

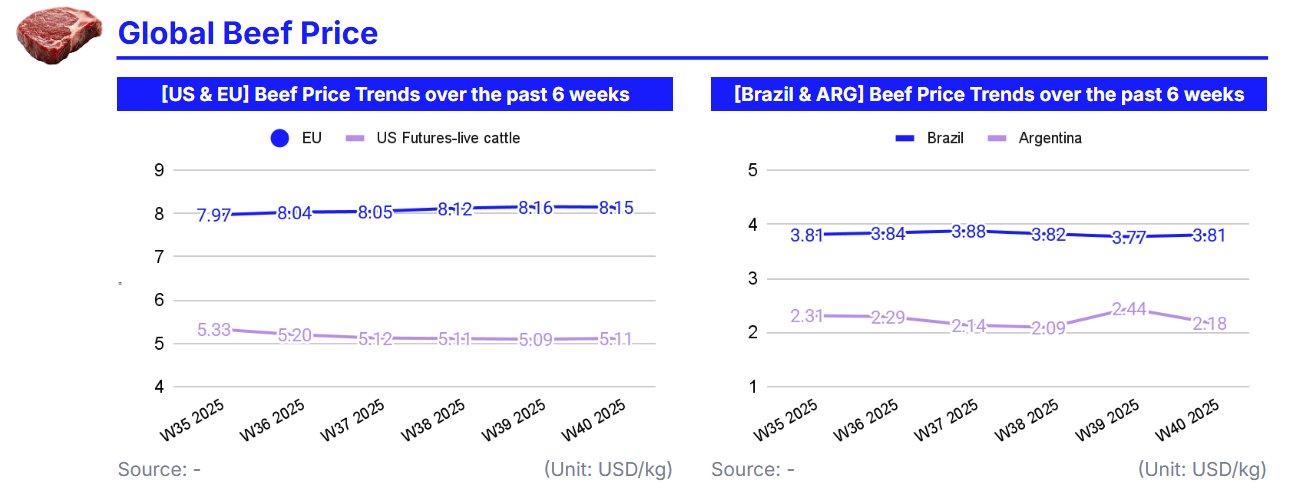

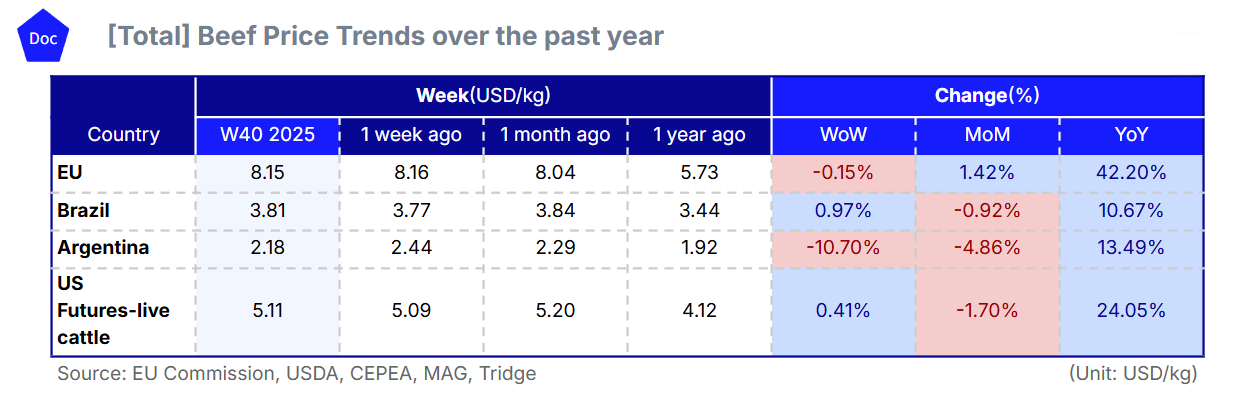

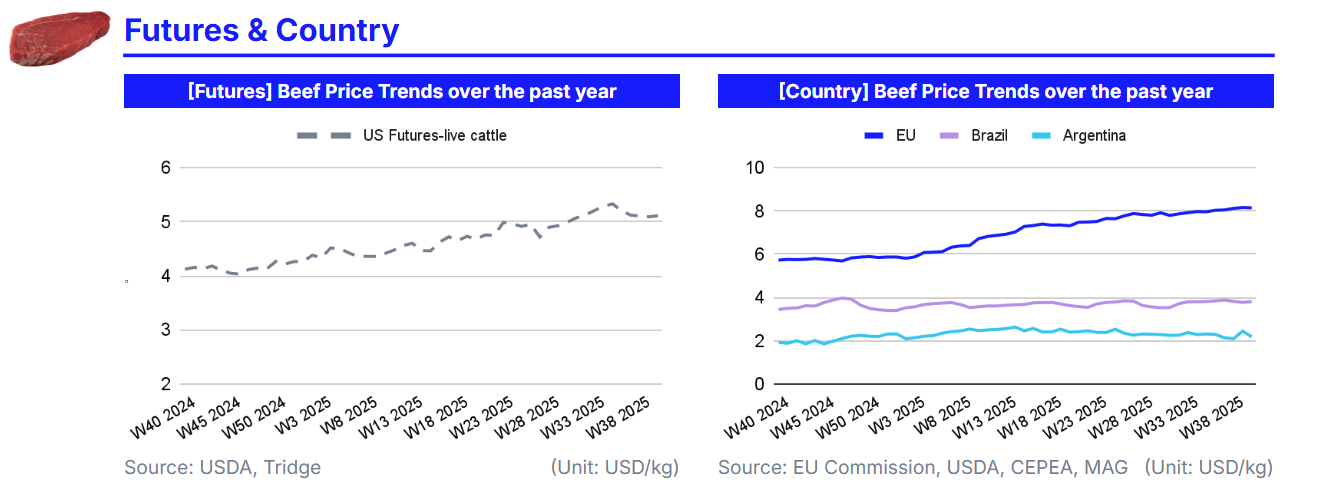

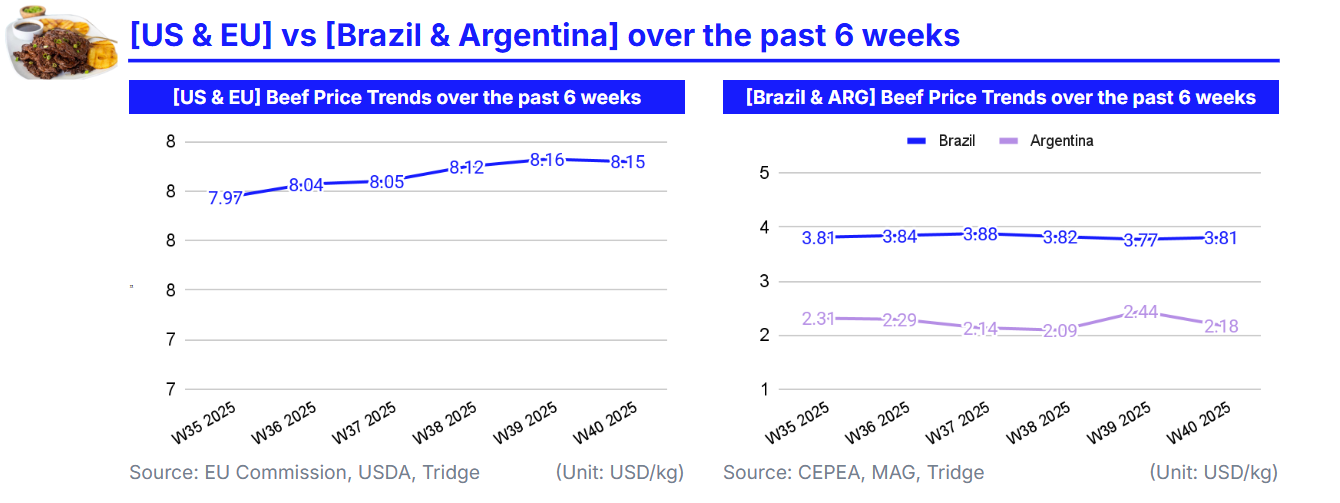

US Futures and Brazilian Beef Prices Rise Amid Tight Supply, While Argentina and EU See Slight Declines

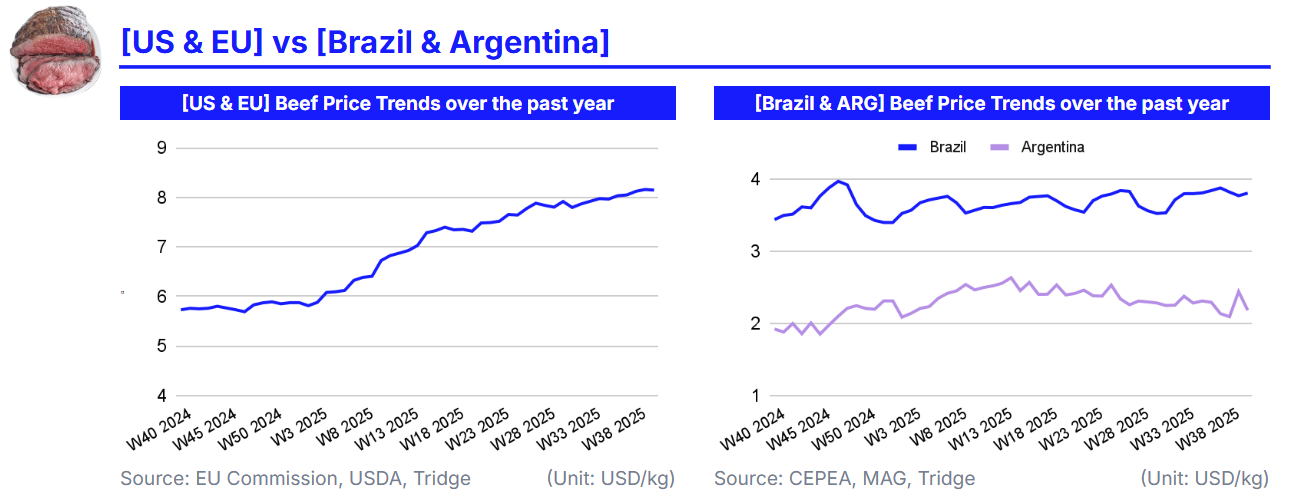

Driven by tight supply and firm demand for high-protein products, US live cattle futures rose 0.41% WoW to USD 4.12/kg in W40, extending the upward trend in beef prices. With breeding cow stocks at their lowest level in over six decades due to drought in key states, domestic production remains insufficient to meet consumption needs. Consequently, the US has increased its reliance on imports, while the average retail price of ground beef reached a record USD 6.32/lb in Aug-25, up 13% YoY. Price strength is supported by constrained supply, resilient demand, and higher import costs following tariffs on Brazilian beef.

In Brazil, beef prices increased 0.97% WoW to USD 3.44/kg, supported by reduced slaughter activity, stronger wholesale demand, and higher consumer spending ahead of year-end holidays. Optimism is reinforced by solid exports, with Sep-25 shipments reaching 314,690 mt worth USD 1.77 billion (+55.6% YoY). Prices are expected to rise moderately in the coming weeks, constrained by slaughter capacity and cattle availability. Argentina’s beef prices fell 10.70% WoW to USD 1.92/kg due to temporary supply corrections after strong export activity. Despite the decline, the country remains a key supplier of premium, traceable beef as global shortages persist. In the EU, prices eased 0.15% WoW to USD 5.73/kg amid lower seasonal demand and stable supply.

Over the past weeks, Brazilian beef prices have continued their upward trajectory, reflecting a combination of tighter domestic supply, firm wholesale demand, and robust export performance. In W40 2025, average prices per arroba (equal to 15kg) in key trading centers rose across most regions, with São Paulo increasing from USD 54.70 to 56.53 (+3.33% WoW) and Rondônia from USD 49.78 to 51.06 (+2.56%), while Mato Grosso and Mato Grosso do Sul remained stable. Wholesale beef markets have maintained firm prices, supported by shorter slaughter schedules at smaller processors, a more fluid domestic market, and the entry of the 13th-month salary, which boosts consumer spending ahead of year-end festivities. Hindquarter and frontquarter beef prices also rose sharply, up 8.7% and 4.12% WoW, respectively, highlighting stronger retail demand.

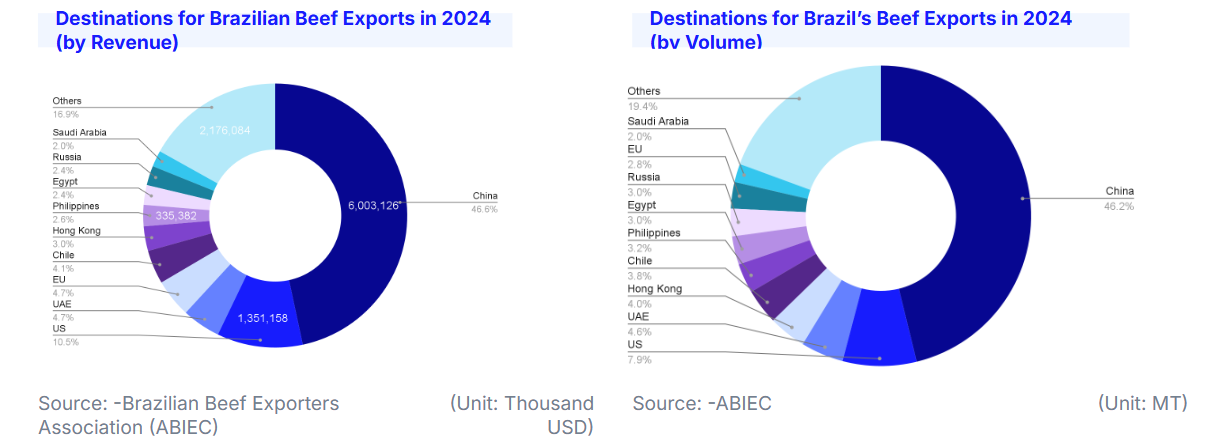

Brazil’s beef exports continue to support price stability and growth, with Sep-25 shipments reaching 352,000 mt and USD 1.9 billion in revenue—the highest monthly volume on record. China remained the main destination, followed by the EU, Mexico, the US, and the Philippines. Despite US tariffs in Aug-25, cumulative exports from Jan-25 to Sep 2025 totaled 2.44 mmt (+16% YoY) and USD 12.4 billion (+35.4% YoY), reinforcing Brazil’s global leadership and benefiting from diversified markets that buffer against trade shocks.

Looking ahead, Brazilian beef prices are likely to continue rising moderately in the coming months. Domestic price adjustments will be supported by sustained consumer demand during the year-end period, firm wholesale markets, and the ongoing strength of international exports. However, short-term price growth may be constrained by limited slaughter capacity and available cattle supply, particularly at smaller processors, suggesting a measured but steady upward trend. The combination of strong domestic fundamentals and robust international demand positions Brazilian beef prices for continued stability and gradual growth through the final quarter of 2025.

Based on current market trends, global beef importers and processors should consider adopting a forward-purchasing strategy for Brazilian beef in the coming months. With domestic supply in Brazil constrained by shorter slaughter schedules, limited cattle availability, and strong wholesale demand, prices are likely to continue rising moderately through the end of 2025. Securing contracts now can help buyers lock in competitive prices before further seasonal or export-driven increases.

The strategy is reinforced by Brazil’s strong export performance, with record shipments in Sep-25 and robust demand from China, the EU, the US, Mexico, and the Philippines. Diversified markets have supported price stability, making Brazilian beef a reliable supply option for global buyers despite US tariffs. Focusing on premium cuts, such as hindquarter and frontquarter beef, may be particularly advantageous, as these segments have shown sharper week-on-week price growth and reflect higher retail demand.

Additionally, buyers could explore sourcing from Argentina for premium, traceable, and deforestation-free beef, which remains competitively priced following a short-term market correction. Positioning Argentine beef alongside Brazilian supply may allow importers to diversify sources, reduce exposure to single-market shocks, and respond to rising global demand for sustainable, high-quality protein.

Read more relevant content

Recommended suppliers for you

What to read next