News

Original content

Analysts at the German forecasting firm Oil World lowered their 2025/26 global sunflower harvest forecast by 700,000 metric tons (mt) to 58.7 mmt. Volumes would still exceed 2024/25 output by 3.6 million metric tons (mmt). The downgrade reflects weaker prospects in Ukraine (12.9 mmt) and the EU (8.75 mmt), where drought has cut yields in France, Bulgaria, Romania, and Spain, alongside a slight reduction in Türkiye (1.18 mmt). Gains in Kazakhstan (2.1 mmt) and Argentina (5.2 mmt) partly offset these declines.

In addition, EU sunflower processing has slumped to multi-year lows, with Q2-2025 volumes down to 1.6 mmt from 2.21 mmt a year earlier. Since the start of the 2024/25 season, processing is down 1.65 mmt year-on-year (YoY) to 7.7 mmt, with the steepest cuts in Bulgaria, Romania, France, and the Netherlands. Limited raw material supply and higher seed costs have eroded margins, prompting processors in Germany, France, and the Netherlands to switch to soybeans, lifting soybean processing to a three-year high of 15.4 mmt. Rapeseed processing has also weakened, falling to 25.06 mmt from 49.28 mmt last year.

Russia consolidated its position as the largest exporter of sunflower oil to India between Jan-25 and Jul-25, with shipments valued at USD 815 million, far surpassing Ukraine (USD 374 million) and Argentina (USD 196 million). India’s total sunflower oil imports during this period reached 1.3 mmt, worth USD 1.6 billion. Russian industry representatives also signaled ambitions to expand exports to Türkiye, further strengthening Russia’s role in the global sunflower oil trade. Beyond sunflower oil, Russian suppliers are promoting a wider range of agricultural products in India, with upcoming trade missions expected to deepen commercial ties and potentially secure new contracts.

Sunflower yields in Russia have declined sharply due to drought, particularly in the Southern Federal District and newly annexed territories, with average yields as of September 15 at 12.3 centners (c), equivalent to 100 kilograms (kg) per hectare (ha), compared to 17 c/ha last year. Key southern regions such as Rostov, Krasnodar, and Donetsk are most affected, while central and Volga regions, along with parts of Tatarstan and Adygea, show higher yields that partially offset southern losses. As of mid-Sep-25, roughly 14% of the sunflower area has been harvested, totaling around 1.4 mmt. Despite early regional setbacks, analysts project Russia’s sunflower harvest for 2025/26 could reach 18 to 18.3 mmt (up to 19.5 mmt), potentially setting a record, supported by strong yields in central, Volga, and Siberian regions. Rapeseed and soybean harvests are also progressing, with regional variations influenced by drought, but overall production is expected to remain above 2024 levels.

Researchers at the University of Granada (UGR) have developed a rapid, environmentally friendly method to differentiate between conventional, medium-oleic, and high-oleic sunflower oils. Using spatially offset Raman spectroscopy (SORS) combined with chemometrics and machine learning, the technique provides accurate results in under two minutes without chemicals. High-oleic sunflower oil, valued for its nutritional benefits and growing popularity, commands higher prices, making verification essential for consumer protection. The method anticipates Spain’s Royal Decree 351/2025, which formally recognizes these three sunflower oil types, offering a practical tool for producers, regulators, and the food industry to ensure transparency and compliance.

Rainfall in western and northern Ukraine is delaying the sunflower harvest, sustaining high prices amid strong demand from processors. Ukrainian sunflower seeds are trading at USD 565 to 585/mt (UAH 26,500 to 27,500/mt) for a 50% oil content, while rapeseed and soybean prices have declined following the introduction of export duties. As of September 12, 570.3 thousand ha have been harvested, yielding 1.55 mt/ha on average, with central and western regions expected to outperform last year. Sunflower oil prices in Ukraine have eased slightly to USD 1,170 to 1,190/mt at Black Sea ports, while Kazakhstan’s prices dropped to USD 1,130 to 1,150/mt on expectations of a larger harvest.

.png)

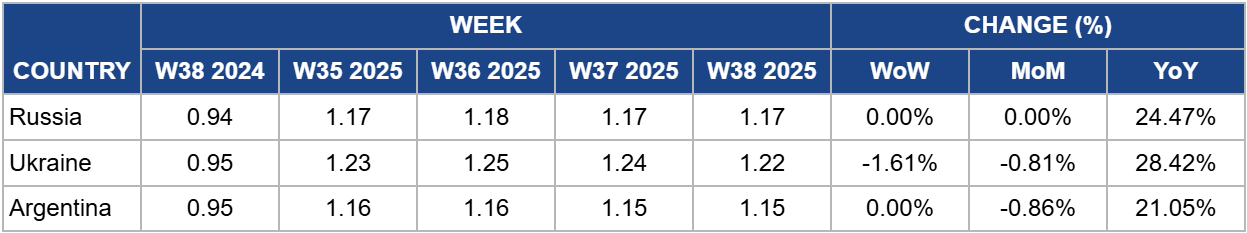

In W38, Russia’s sunflower oil prices held steady at USD 1.17/kg, showing no weekly or monthly movement but registering a strong 24.47% YoY increase from USD 0.94/kg. Despite drought-driven yield losses in southern regions such as Rostov, Krasnodar, and Donetsk, stronger output in central, Volga, and Siberian areas is expected to offset early setbacks, keeping the 2025/26 harvest forecast at 18 to 18.3 mmt, potentially reaching 19.5 mmt, a record high.

Stable domestic prices, alongside Russia’s position as India’s top sunflower oil supplier with USD 815 million in exports from Jan-25 to Jul-25, suggest that strong external demand will continue to support market stability. However, harvest delays and regional yield volatility could create upward price risks if supply tightness emerges before larger volumes from central and eastern regions enter the market.

In W38, Ukraine’s sunflower oil prices declined slightly by 1.61% week-on-week (WoW) to USD 1.22/kg, though they remain 28.42% higher YoY from USD 0.95/kg, reflecting strong underlying demand. Harvest delays in western and northern Ukraine due to rainfall are sustaining high sunflower seed prices, currently at USD 565 to 585/mt for 50% oil content, as processors compete for fast delivery. Despite the minor weekly price drop, elevated seed costs and firm processor demand are likely to support sunflower oil prices in the near term. However, increasing harvest progress in central and western Ukraine, coupled with falling prices in Kazakhstan and moderate Russian supply growth, may temper further price rises and stabilize the market in the coming weeks.

In W38, Argentina’s sunflower oil prices held steady at USD 1.15/kg, showing no WoW movement but rising 21.05% YoY from USD 0.95/kg. Stability is partly linked to expectations of higher global sunflower production in 2025/26, yet prices remain elevated on the back of record crushing volumes in Jul-25 that generated strong foreign currency inflows.

Reduced export duties on soybean and sunflower products have further supported Argentina’s competitiveness, boosting sunflower oil exports to 218,000 mt in Jul-25, the highest in four years. Robust foreign demand and high-capacity utilization in sunflower crushing are expected to sustain price levels, though future gains may be moderated by supply fluctuations and competition from other vegetable oils.

Industry stakeholders in Russia, Ukraine, and Argentina should align harvest, crushing, and export schedules to optimize supply availability amid tight global markets. Investments in logistics, storage, and processing capacity can ensure timely delivery to key destinations such as India, Spain, and Italy, supporting price stability and maintaining market share.

Producers and processors should expand high-oleic sunflower cultivation and promote verified quality through rapid analytical methods such as Raman spectroscopy. Targeting premium markets in Europe and the Mediterranean can capture higher margins, particularly where sunflower oil competes with olive oil or other specialty oils.

Sunflower growers in drought-prone regions of the EU, Ukraine, and Russia should adopt climate-resilient seed varieties, improve irrigation systems, and diversify planting locations. These measures will mitigate yield risks, sustain processing margins, and reduce vulnerability to regional production shortfalls that could disrupt global supply and elevate prices.

Sources: Tridge, Rosng, Sinor, Agravery, AgroInvestor, Ukr Agroconsult, Grain Trade, UGR

Read more relevant content

Recommended suppliers for you

What to read next