Original content

Global beef demand continues to outpace supply, pushing prices to record highs in key markets. Within the Hilton quota, Argentine rump, loin, and ribeye cuts are selling in the European Union (EU) at USD 18,000–18,300 per metric ton (mt), with ribeye alone nearing USD 19,000/mt, the highest nominal values on record. Europe, which absorbs 20% of Argentina’s beef exports, generated roughly USD 550 million in earnings from the quota in the first half of 2025 (H1-2025), with sales to Germany, the Netherlands, and Italy up 30%, 60%, and 20% respectively. Declining EU production and limited steer availability in Argentina are tightening supplies, lifting cattle prices by 15% since Jul-25 to USD 4.26 to 4.33 per kilogram (ARS 5,800–5,900/kg). Complementary demand from the US (USD 11,000/mt) and China further supports firm global pricing, suggesting continued upward pressure on beef and cattle values in the near term.

In Jul-25, Argentine beef exports totaled 62.2 thousand mt, valued at USD 346.9 million, reflecting a 1% decline in volume but a 5.5% increase in value compared to Jun-25. Exports rose 9.7% year-on-year (YoY) in volume and 51.7% YoY in value, supported by higher average prices, which reached USD 5,577/mt, 6.6% above Jun-25 and 38.2% higher than Jul-24. For the first seven months of 2025, cumulative shipments reached 376,245 mt, generating USD 1.943 billion, a 14.5% decrease in volume but a 17.6% increase in revenue compared to the same period in 2024. Premium cuts, including boneless fresh and chilled products, recorded a 23% YoY value increase, while boneless frozen beef—dominated by China—rose nearly 40%. However, Jul-25 saw a 7% decline in shipments to China amid trade disruptions and rising Brazilian competition, signaling potential volatility in the coming months. With peak export activity expected in the September–November period, maintaining strong volumes will be critical to reaching 2024’s annual export levels.

The São Paulo beef cattle market remained stable on August 28, following a prior increase, with both standard and Chinese cattle holding steady across categories as supply met demand and slaughter schedules averaged nine days. Strong export demand helped sustain prices despite slower domestic consumption. Regional variations were observed in Pará, where Redenção saw higher beef cattle prices, Paragominas recorded rises for Chinese cattle and heifers, and Marabá remained stable. In Bahia, female cattle prices increased, with cows rising in the south and heifers in the west, while other categories remained unchanged.

In the second week of Aug-25, China’s beef market showed stability with moderate increases. The national average price of beef reached USD 9.80/kg (CNY 70/kg), up 0.2% week-on-week (WoW) and 2.3% YoY. In major producing provinces, including Hebei and Inner Mongolia, beef prices were USD 9.01/kg (CNY 64.33/kg), rising 0.5% from the previous week, while live cattle prices increased 0.5% to USD 3.76/kg (CNY 26.84/kg), up 11.3% YoY. Mutton prices also saw slight gains, with the national average at USD 9.64/kg (CNY 68.86/kg), up 0.2% WoW but down 2.1% YoY. Overall, supply and demand remained balanced, supporting stable beef and live cattle prices across the country.

Paraguay ranks ninth among the world’s top beef exporters, with an estimated 500,000 mt in 2025, surpassing Uruguay’s projected 485,000 mt, according to the United States Department of Agriculture (USDA). Paraguay accounts for 4% of global beef production, which is expected to reach 61 mmt this year. As of Jul-25, Paraguayan beef exports totaled USD 1.209 billion, up 29.2% YoY, with a nearly 10% increase in volume to 212,600 mt. Chile is the largest importer at USD 398.9 million, followed by Taiwan, Israel, and the US. Export prices have risen notably, with Israel paying USD 6,414/mt, Brazil USD 6,372/mt, and Chile USD 5,999/mt. Paraguay’s record export performance in H1-2025 reflects both higher value and growing volume, continuing a positive trend in recent years.

The Ministry of Agriculture, Food and Rural Affairs (MAFRA) conducted a 'Cow Prize Hanwoo Discount Event' from August 25 to September 5, in collaboration with the Hanwoo Self-Help Fund, the National Hanwoo Association, and Nonghyup Economic Holdings, offering Hanwoo beef at 30–50% discounts to stabilize fall consumer prices. Large online malls will launch promotions on August 25, while 519 Nonghyup Hanaro Marts and major supermarkets nationwide will begin discounts on August 29. Participating stores will offer sirloin, brisket, bulgogi, and soups, graded 1+ to 2, with Grade 1 sirloin priced around USD 4.83/100kg (KRW 6,730/100kg), brisket USD 2.85 (KRW 3,970), and bulgogi and soups USD 2.10 (KRW 2,920) or less, representing a 17–25% reduction compared to Aug-24 prices.

Spain's beef cattle sector has resisted the severe challenges facing the wider agricultural industry during a devastating summer of wildfires. While over 400,000 hectares (ha) have burned in 2025, ranchers have largely avoided direct livestock losses, though many face damaged pastureland and rising costs. Despite this, beef cattle prices continue to climb, with Salamanca’s Agricultural Exchange showing consistent weekly increases in Aug-25. Notable gains include females under 12 months rising by USD 0.058/kg (EUR 0.05/kg) carcass in W35, building on earlier increases, while veal over 12 months also advanced by USD 0.058/kg (EUR 0.05/kg) across categories. Analysts attribute this trend to structural factors, including reduced livestock numbers, production challenges, and strong demand, which are expected to keep prices elevated in the near term.

The USDA Agricultural Marketing Service (AMS) has authorized three new automatic carcass grading systems for use in its beef grading program. The approved technologies—Global Meat Imaging GMI for Google Pixel 7a, JBT/Marel/E+V VBG2000-7L, and MEQ Camera V2 by MEQ Inc.—will modernize grading operations by predicting marbling scores, applying yield grades, and measuring ribeye area. According to the USDA, these systems will enhance consistency, transparency, and data-driven decision-making in carcass evaluation, ultimately improving producer payments, market efficiency, and communication of quality standards to consumers.

.png)

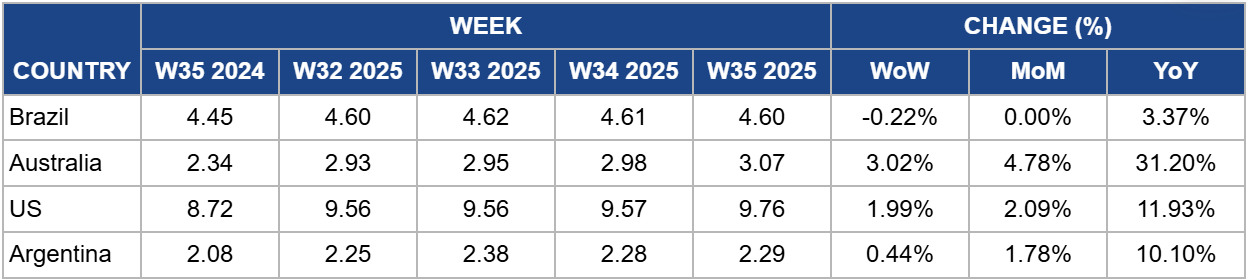

In W35, Brazil's wholesale beef price declined slightly by 0.22% WoW to USD 4.60/kg, marking a 3.37% YoY increase from USD 4.45/kg. In local currency, cattle prices showed significant gains in Aug-25, with São Paulo at USD 56.91 (+3.33% MoM), Goiás USD 55.99 (+7.02% MoM), Minas Gerais USD 55.99 (+5.17%), Mato Grosso do Sul USD 57.82 (+3.28%), Mato Grosso USD 57.82 (+6.78%), and Rondônia USD 285 (+7.55%). Strong export-oriented demand drove much of this recovery, particularly during the first half of the month, while recent trading slowed as meatpackers secured favorable offers to expand slaughter schedules. Analysts anticipate potential price increases in early Sep-25, supported by strong wholesale-retail spreads and renewed wage-driven consumer demand. Overall, the market is likely to sustain upward momentum, with cattle and beef prices remaining resilient in both domestic and export channels.

In W35, Australia’s beef prices rose 3.02% WoW to USD 3.07/kg, marking a 31.20% YoY increase from USD 2.34/kg in W35 2024. According to Meat & Livestock Australia (MLA), the national cattle herd is expected to remain stable at 31 million heads in 2025, supported by strong seasonal conditions in the north and strategic herd management in the south. Slaughter is forecast to increase 8.6% to 9.02 million heads, with carcase weights stable at 309.5 kg/head, underpinned by a high proportion of grainfed cattle and improved pasture conditions. Beef exports are projected to reach 1.5 mmt shipped weight, benefiting from global supply constraints in the US, Brazil, and Australia’s strong processing capacity and trade relationships. Looking ahead, the herd is expected to remain stable through 2026, with ongoing improvements in carcase weights and processing efficiency supporting sustained production levels, positioning Australia to meet both domestic and international demand.

In W35, US lean beef (92%–94%) averaged USD 9.76/kg, rising 1.99% WoW and 11.93% YoY. Prices remain supported by ongoing tight supply conditions, including constrained cattle inventories and elevated domestic demand. Total US cattle inventory reached 94.2 million heads as of July 1, with 28.7 million beef cattle, reflecting modest recovery but remaining slightly below year-ago levels. Trade developments are also influencing market dynamics: the 50% tariff on Brazilian beef imposed in Aug-25 restricts a major supply source, while border disruptions with Mexico due to recent New World screwworm concerns may further limit live cattle imports. Although the human case of screwworm in Maryland poses minimal risk to the cattle industry, according to the USDA and the National Cattlemen’s Beef Association (NCBA), it has prompted heightened surveillance. These factors collectively support near-term price firmness and suggest continued upward pressure on US lean beef prices. Meanwhile, ongoing monitoring of herd trends, import flows, and international supply constraints will be critical for forecasting future market movements.

In W35, Argentina’s average steer beef price rose 0.44% WoW to USD 2.29/kg, marking a 10.10% YoY increase. The weekly gain reflects steady export demand, particularly from markets where Argentina maintains a competitive position, and ongoing domestic consumption supported by the country’s cultural preference for beef. While structural challenges—such as outdated rural infrastructure and limited investment—may constrain broader export growth, Argentina remains a global leader in beef exports, ranking sixth worldwide, and in other agro-industrial products that generate critical foreign currency. These factors underpin price stability and support near-term upward pressure, although future trends will depend on maintaining export competitiveness, managing domestic supply, and addressing infrastructural bottlenecks that could influence production efficiency and market access.

Argentina should capitalize on the current global beef shortage and strong EU, US, and Chinese demand by diversifying export markets and reducing reliance on any single buyer. Targeting premium cuts to high-value destinations, such as the EU and the US, while exploring emerging markets in the Middle East and Southeast Asia, can enhance resilience against trade disruptions and rising competition from Brazil. Concurrently, investment in modernizing slaughterhouses, cold-chain logistics, and certification systems will ensure quality consistency, supporting higher export prices and long-term revenue growth.

Producers across major beef-exporting countries should implement strategic herd management and production improvements to balance tightening global supply with rising demand. Measures include improving feed efficiency, adopting advanced breeding and health management practices, and stabilizing slaughter schedules. These actions will help maintain steady domestic supply, support cattle prices, and ensure sufficient volumes for export markets, particularly during peak shipping periods.

Argentina and major producers should adopt modern carcass grading, yield prediction, and data-driven market monitoring systems to improve pricing transparency and producer decision-making. Implementing automated grading technologies, similar to USDA-approved systems, can optimize value capture, reduce disputes, and facilitate access to premium markets. Enhanced market intelligence will allow producers and exporters to anticipate price trends, adjust supply allocations efficiently, and strengthen competitiveness in a tightening global beef market.

Sources: Tridge, Canal Rural, Agromeat, AFL News, News Foodmate, MLA

Read more relevant content

Recommended suppliers for you

What to read next