News

Original content

In 2025, Bulgaria expanded sunflower plantings by 67% year-on-year (YoY) to 985,000 hectares (ha), with forecasts pointing to a harvest of 1.8 to 2.0 million metric tons (mmt), compared to 1.4 to 1.5 mmt in 2024. Favorable weather supports expectations for a record crop, though some farmers project lower yields. Increased supply, combined with record harvest prospects in Russia (18 mmt), is set to intensify competition in the Black Sea region and exert further downward pressure on sunflower oil prices. Bulgarian processors, already diversifying into other oilseeds, are leveraging lower domestic prices to offer competitively priced sunflower oil in the European Union’s (EU) markets, at times undercutting Ukrainian exports.

Kazakhstan's sunflower oil sector showed strong growth in 2025, with unrefined output reaching 365,400 metric tons (mt) in the first seven months, up 24.9% YoY. Exports increased by 46.2% in the first half of 2025 (H1-2025), led by shipments to Russia and China, with additional volumes reaching regional and European markets. The surge is linked to a 36% expansion in oilseed planting, including a record sunflower sown area. However, average capacity utilization remained low at 35%, highlighting significant untapped potential for further processing growth.

Kazakhstan’s 2025 sunflower harvest is forecast to deliver above-average yields in key districts across Kostanay, Abay, and East Kazakhstan regions, supported by favorable temperatures and adequate rainfall. Other areas, including Pavlodar and parts of Abay and Kostanay, are expected to achieve near-average yields. Overall, conditions indicate a strong sunflower crop with sufficient moisture and healthy development, supporting stable production prospects for the country.

The Konya Plain has emerged as Türkiye's second key sunflower production region after Thrace, contributing around 200,000 mt to the country’s annual sunflower oil output of 1.85 mmt. Experts highlight that most sunflowers in the region are cultivated in irrigated areas, limiting yield losses compared to grains despite dry weather. The high oil content and quality of Konya's crop are expected to support favorable pricing with the upcoming harvest. While some yield reductions may occur in non-irrigated areas, overall supply is seen as sufficient for domestic consumption, with occasional export volumes. Authorities are also prepared to provide support if farmer margins weaken, minimizing potential price impacts for consumers.

Ukraine's sunflower oil sector faces mixed dynamics in 2025/26. Despite weather-related damage from drought in the south and east and excess moisture in the north and west, reducing yield and quality, exports of sunflower oil and meal are projected to surpass 2024’s levels. Domestic prices have already begun rising as harvest losses tighten supply, while processors increasingly shift to soybeans and rapeseed, which performed better under adverse conditions. Notably, India imported more sunflower oil from Ukraine than from Russia for the first time since the war, aided by rerouted shipments through Europe.

Ukraine strengthened its position in the Indian sunflower oil market in mid-2025, with exports rising 57% month-on-month (MoM) in Jul-25 to 78,000 mt. Ukrainian oil accounted for 39% of India's sunflower oil imports that month, surpassing Russia's 25% share for the first time in two years. This shift reflects reduced Russian output amid weak margins and higher export duties, which lowered competitiveness. From Sep-24 to Jul-25, Ukraine shipped 767,000 mt to India, up 55% YoY and the highest since 2022, consolidating India as its top buyer. Rising palm oil prices supported demand for sunflower oil, though gains were capped by cheaper soybean oil alternatives.

.png)

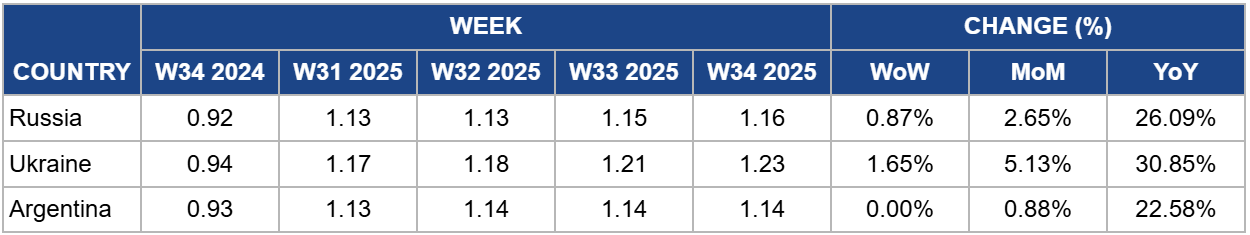

In W34, Russia's sunflower oil prices increased by 0.87% week-on-week (WoW) to USD 1.16 per kilogram (kg), reflecting a 26.09% YoY increase. Despite this rise, demand prices for Aug-25 to Sep-25 deliveries fell by USD 5–10/mt to USD 1,130–1,135/mt FOB, influenced by forecasts of a good harvest and the onset of seasonal price declines. Ukrainian sunflower oil prices also eased slightly, signaling moderation across Black Sea markets.

Domestic Russian prices remain firm at USD 1,170–1,200/mt Free Carrier (FCA) due to limited supply and strong demand from processors and exporters. Favorable Aug-25 weather is supporting crop development, suggesting harvest volumes will meet forecasts, though harvesting will start later than usual in early Sep-25. Strong harvest prospects in Russia are expected to intensify market competition, potentially placing downward pressure on international sunflower oil prices.

Ukraine's sunflower oil prices rose 1.65% WoW to USD 1.23/kg, marking a 30.85% YoY increase, yet near-term pressure is emerging. Domestic sunflower seed prices fell to USD 649.01 to 653.86/mt (UAH 26,800 to 27,000/mt) as processors slowed purchases, while export values eased to USD 1,150–1,160/mt FOB. The delayed mass harvest, with weak yields in the drought-hit south and east but stronger output in central and western regions, is expected to keep raw material demand firm until mid-Sep-25. However, the switch of many plants to rapeseed processing limits immediate upside, reducing the likelihood of a price rally. Moreover, favorable crop conditions in Russia, Kazakhstan, Bulgaria, and Romania point to rising global supply, which could accelerate sunflower oil price declines into Sep-25 and Oct-25 despite current strength.

In W34, Argentina's sunflower oil prices held steady, showing no weekly changes but rising 22.58% YoY. Strong industrial activity continues to support the market, with Jul-25 crushing reaching a record 487,541 mt, the highest in a decade, and cumulative Jan-25 to Jul-25 rising to 2.72 mmt. Exports also strengthened, with volumes up 27% and values up 43% in H1-2025, totaling 1.41 mmt worth USD 905 million. While stable prices reflect current market balance, record production and robust export performance may heighten global competition, increasing the risk of price pressure in the Black Sea and EU markets in the coming months.

Producers and processors in Kazakhstan, Bulgaria, and Russia should focus on maximizing processing capacity and operational efficiency. With Kazakhstan’s average processing utilization at only 35% despite strong harvests, investments in modern crushing facilities and optimization of existing plants can convert untapped raw material into export-ready sunflower oil. Higher processing throughput will help maintain competitiveness amid rising global supply and falling prices.

Sunflower oil exporters, particularly from Ukraine, Argentina, and Bulgaria, should expand their international footprint beyond traditional markets. Leveraging premium-quality oil from irrigated regions such as Türkiye’s Konya Plain and targeting growing demand in India, China, the EU, and emerging markets in Africa and Latin America can offset competitive pressures from Russia and other Black Sea producers. Active marketing and long-term supply agreements will secure stable demand and mitigate exposure to short-term price volatility.

Traders, buyers, and policymakers should closely track weather conditions, yield developments, and crop forecasts across major producing countries. Anticipating surpluses in Bulgaria, Russia, and Kazakhstan, alongside drought-impacted but export-active Ukraine, will enable strategic sourcing, contract timing, and pricing decisions. Timely adjustments can help mitigate the risk of declining prices and capitalize on short-term supply imbalances in key global markets.

Sources: Tridge, Ukr Agroconsult, the Ukrainian Independent Information Agency (UNIAN), Superagronom, Grain Trade, Agri, Kamu3, Argentina Gov

Read more relevant content

Recommended suppliers for you

What to read next