News

Original content

Despite being the world's third-largest olive oil producer, with 82% of its output being high-quality extra virgin, Greece is losing an estimated USD 300 to 350 million (EUR 250 to 300 million) in annual revenue due to a critical lack of branding. The country exports the majority of its oil in bulk, primarily to Italy and Spain, where it is then blended, bottled, and re-exported under foreign labels at a significant markup. This strategy means that only 5% of Greek olive oil is sold abroad under a Greek brand, leaving the nation with second-class profits for its world-class product. While global olive oil production is set to rebound, Greece's failure to invest in domestic bottling and marketing continues to undermine its potential, ceding both value and international recognition to its main competitors.

According to the Economic and Commercial Affairs Office of the Greek Consulate in Shanghai, China’s olive oil market has surpassed USD 1.1 billion (CNY 8 billion) and is projected to grow at 8-10% annually, driven by both imports and expanding domestic production. Between 2018 and 2023, China's olive cultivation area grew from approximately 80,000 hectares (ha) to around 135,000 ha, a 69% increase. This rise in local production comes as Greek olive oil exports to China are in decline, falling from USD 1.55 million (EUR 1.33 million) in 2000 to below USD 1 million in 2024. The trend highlights a significant missed opportunity for Greek producers in one of the world's fastest-growing markets. As China continues to build its domestic capacity, the Greek sector faces the long-term risk of losing ground to domestic Chinese production as well as other European export countries such as Spain, Greece, and Italy.

A lawsuit has been filed in the United States (US) against the parent companies of the Bertolli olive oil brand, Deoleo USA Inc. and Med Foods Inc., alleging deceptive labeling practices. The suit claims that products labeled as ‘Imported from Italy’ are, in fact, sourced from various other countries including Tunisia, Turkey, Greece, Spain, Chile, and Australia, and are only blended and bottled in Italy–a practice the lawsuit argues is misleading to consumers. Furthermore, the lawsuit challenges the extra virgin quality claim, alleging that the oil is mixed with refined oils and packaged in clear bottles. This exposure to light and heat allegedly causes the oil to degrade during shipping and on retail shelves, meaning it no longer meets the high standards of extra virgin quality by the time of purchase. The plaintiffs accuse the company of duping consumers into paying a premium for a product that is not what it claims to be.

Despite a domestic production crisis, the Italian olive oil sector is demonstrating remarkable strength in its export markets. This is highlighted by a significant market shift between 2022 and 2024, where a 10% reduction in the sales volume of extra virgin olive oil was offset by a massive 64% increase in its value, indicating that less oil is being sold but at much higher prices. This export growth is highly concentrated, with 65% of the total value coming from just five countries, led by the US with 32%, followed by Germany with 15.5%, France with 7.9%, Canada with 4.7% and Japan with 5.3%. Furthermore, Italian extra virgin olive oil is outperforming the general market in several key destinations. For example, from Jan-24 to Nov-24, the value of Italian olive oil exports grew by 58% in Germany, 141% in South Korea, 192% in Australia and 99% in Mexico, in each instance outpacing the growth of overall olive oil sales.

This trend underscores the critical importance of the export sector, as international markets are increasingly willing to pay a premium for Italian olive oil, providing a vital lifeline for the industry's profitability while domestic consumers turn to cheaper alternatives. Although Europe and North America remain the largest export destinations, interesting signs of growth can be seen in South America and Asia, with increases in olive oil imports between 2013 and 2023 in Chile and Peru (+15%), Colombia (+13%), South Korea (+12%), and Indonesia (+11%). These markets are ideal for Italian olive oil exporters to target to further expand their export footprint.

Spain's upcoming 2025/26 olive oil harvest is in serious jeopardy following a summer of extreme heat that has severely affected the olive crop. Record temperatures in Jul-25 and Aug-25 have caused significant fruit loss and reduced the size of the remaining olives, drastically dampening initial, optimistic expectations for the 2025/26 season. The damage has been so significant that the Committee on Agriculture (COAG) of the Food and Agriculture Organization (FAO) is now warning of a potential 30% reduction in olive production. While the final outcome will depend on September's weather, the grim outlook has already caused prices at the source to rise. With 87% of the previous harvest already sold and stocks tightening, the sector is anxiously watching the weather as the new season's supply, which once looked promising, is now in serious jeopardy.

Tunisia's National Oil Council is already preparing for the 2025/26 olive oil season, with officials meeting on Friday, August 22, 2025, under the supervision of the Minister of Agriculture. The meeting brought together representatives of public structures and the olive sector. The meeting noted that early signs for the upcoming harvest are positive. The early planning aims to correct shortcomings from the current season and improve coordination across the sector, from production to marketing. This proactive approach comes against a backdrop of paradoxical export results for the current season. Tunisia successfully increased its export volume to 239,000 metric tons (mt) during the 2024/25 season, a 35% rise compared to the previous season. However, the value of olive oil exports fell by 31.1% during the first seven months of 2025. This was driven by a staggering 52.3% collapse in the average export price, highlighting the immense challenge producers face in a well-supplied global market. The focus for the new season will be on better managing these market dynamics to improve profitability.

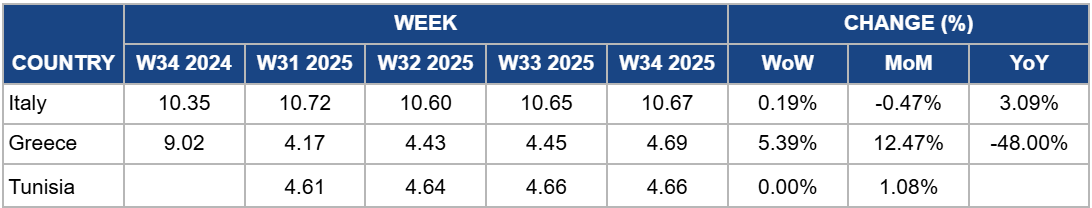

In Italy, the price of extra virgin olive oil was USD 10.67/kg in W34, a slight increase of 0.19% week-on-week (WoW). The price is down 0.47% month-on-month (MoM) but remains 3.09% higher year-on-year (YoY). The Italian olive oil market continues to hold firm at a significant premium, with the slight WoW price increase reflecting the deep-seated supply scarcity. With domestic stocks of authentic Italian extra virgin olive oil critically low, any renewed buying interest from packers immediately puts upward pressure on the limited available volumes. However, the marginal MoM decrease indicates that the market has found a high-level equilibrium, stabilized by the industry's reliance on a steady flow of imports from Spain and Greece, which has prevented further significant price spikes during the summer slowdown. The long-term trend remains the 3.09% YoY price increase. This is a direct consequence of Italy's severe 2024/25 production crisis, which saw the harvest fall by 25%. This fundamental supply deficit is the primary driver supporting the sustained price premium for Italian-origin oil.

In Greece, the price of extra virgin olive oil in W34 was USD 4.69/kg, a sharp increase of 5.39% WoW. This represents a substantial 12.47% MoM rise, though the price remains 48.00% lower YoY. The Greek olive oil market has experienced a significant short-term price rally, breaking its recent stability. The strong WoW and MoM increases are driven by a classic end-of-season supply squeeze, as dwindling inventories of high-quality oil are met with renewed buyer interest, particularly from Italian packers looking to cover their domestic shortfalls. This demand is intensified by mounting pressure on Greek producers to sell their remaining stocks before high summer temperatures degrade the quality, forcing the last available volumes onto the market at a premium. However, the massive 48.00% YoY price collapse remains the long-term trend. This is a direct consequence of the strong production rebound in both Greece and, more significantly, Spain during the 2024/25 season, which ended the severe scarcity and record-high prices of the previous year.

In Tunisia, the price of extra virgin olive oil was USD 4.66/kg in W34, stable WoW and up 1.08% MoM. The Tunisian olive oil market has reached an equilibrium as the season concludes, with the flat WoW price reflecting a quiet market with minimal trading activity. However, the MoM increase is driven by end-of-season scarcity, with domestic stocks now almost entirely depleted and quality concerns rising due to the summer heat. Resultantly, the last available volumes are commanding a slight premium compared to a month ago.

The annual loss of USD 300 to 350 million USD for the Greek olive oil industry is not just a failure of individual companies to bottle their oil but is also a failure to build a national brand. The key strategic action is not just to bottle oil in Greece, but to launch a coordinated national initiative to elevate the perception of Greece as an origin of high-quality olive oil. This involves creating and promoting a unified narrative around the superior quality, heritage, and unique characteristics of Greek olive oil. By investing in global marketing campaigns, certifications of origin, and participation in international food expositions under a single, powerful Greek banner, the entire sector can work to position its product as a premium offering. This collective effort can raise the price ceiling for all Greek producers, shifting consumer perception and enabling the country to transition from being a bulk supplier to a globally recognized leader in premium bottled and branded olive oil.

The US lawsuit against Bertolli's parent companies represents a significant threat to the entire "Made in Italy" brand premium. To mitigate this risk and future-proof Italian brand, the recommended action is to pivot from opaque origin claims to a marketing strategy centered on transparency and expertise. Instead of relying solely on the "Imported from Italy" label, companies can develop and promote premium blends that openly celebrate their Mediterranean origins. Market these products as "Expertly selected and blended in Italy," turning your blending process from a potential liability into a mark of quality curation. This preempts deceptive labeling claims, builds consumer trust, and protects the high-margin business model that is vital for the industry's profitability.

The severe summer heatwave has created a dire outlook for Spain's 2025/26 harvest, but it also presents a clear, albeit challenging, commercial opportunity. With COAG already warning of a potential 30% reduction in production and prices at the source beginning to rise, the recommended action is to leverage this scarcity forecast to secure favorable forward contracts for the upcoming harvest. With 87% of the previous year's stocks already sold, buyers will soon face a critically tight market. Producers and exporters can proactively engage with major buyers now, using the official production warnings to negotiate contracts at favourable prices. This strategy locks in higher revenue for the reduced anticipated volume, hedging against future price volatility. By controlling the narrative around supply scarcity, producers and exporters can convert the unfortunate climate event into a tactical approach to maximize the value of every olive harvested this season.

Sources: Tridge, Top Class Action, Wine Reporter, Tovima, Greek City Times, EFEAGRO, Webdo

Read more relevant content

Recommended suppliers for you

What to read next