Original content

China's Ministry of Commerce has officially extended its anti-subsidy investigation into dairy imports from the European Union (EU), pushing the new deadline to Feb-26. While Chinese authorities cited the complexity of the case as the reason for the six-month extension, the move is widely viewed by market analysts as a strategic maneuver within the broader context of ongoing trade frictions between Beijing and Brussels. Trade tensions between China and the EU erupted in 2023 when the European Commission (EC)—which oversees the bloc's trade policy—launched an anti-subsidy investigation into Chinese-made electric vehicles. The investigation, which targets products such as cheese, milk, and cream, is largely seen as a retaliatory measure following the EU's own anti-subsidy probe into Chinese-made electric vehicles. This extension prolongs a period of significant uncertainty for European dairy exporters, who consider China a critical market. The potential for China to impose countervailing duties at the conclusion of the probe poses a substantial threat to the profitability and market access for EU producers. Industry stakeholders are now closely watching for developments in high-level trade talks scheduled for Sep-25, as the dairy investigation is expected to be used as a key bargaining chip by Beijing to negotiate concessions in other sectors. A resolution to the wider trade disputes is seen as crucial to mitigating the risk of disruptive tariffs on EU dairy products.

The United States (US) and the EU in Aug-25 announced a new joint framework for fair, balanced, and mutually beneficial transatlantic trade and investment. The US and the EU intend this framework agreement to be a first step in a process to improve market access and increase their trade and investment relationship. According to the White House, the new trade agreement would eliminate tariffs on and provide preferential market access for US dairy products in the EU and commit to resolving certain non-tariff barriers, including streamlining requirements for dairy sanitary certificates. However, the initiative has immediately highlighted the conflicting positions of the respective industry bodies. Major US dairy organizations, including the US Dairy Export Council and the National Milk Producers Federation, have responded with skepticism. They insist that any agreement must move beyond aspirational goals to deliver concrete, enforceable changes that dismantle what they consider to be long-standing European protectionist policies. Conversely, EU dairy industry representatives are expected to defend the bloc's stringent regulatory standards and quality schemes. They view the US push for greater access as a potential threat to their market stability and product integrity, and will likely resist changes that could undermine the integrity of their producers. This fundamental disagreement between the US industry's demand for open access and the EU's defense of its established market structure presents a significant challenge for future negotiations.

Ehrmann Cornish Dairy has unveiled plans for a USD 27 million (GBP 20 million) investment in a new state-of-the-art production facility at the Trewithen Dairy site in Cornwall. The news follows the merger of Ehrmann and Trewithen Dairy, which created Ehrmann Cornish Dairy. The new entity, Ehrmann Cornish Dairy, will operate out of the Trewithen Dairy site in Cornwall. The significant investment is targeted at extensively upgrading and expanding the existing plant, creating a modern manufacturing facility for the UK market. This strategic move is designed to localize the production of Ehrmann's popular yoghurt and dessert brands, which are currently imported. By manufacturing domestically, the company aims to create a more resilient and efficient supply chain to better serve its major UK retail partners. The newly upgraded facility is slated to begin operations in 2026, marking a significant development in the UK's value-added dairy processing landscape.

New Zealand's Fonterra Co-operative Group has agreed to sell its global consumer business and associated operations to French dairy giant Lactalis in a landmark deal valued at USD 2.24 billion (NZD 3.845 billion). The acquisition includes Fonterra's portfolio of iconic consumer brands such as Mainland and Anchor butter, Kapiti ice cream and cheese, and the Anlene powdered milk supplement. The transaction also covers the dairy company's foodservice and ingredients businesses in Oceania and Sri Lanka, along with its Middle East and Africa foodservice operations. This move marks a significant strategic shift for Fonterra, allowing the co-operative to divest from its consumer-facing assets and intensify its focus on its core business of selling high-value dairy ingredients to other companies. Following the sale, Fonterra plans to execute a substantial tax-free capital return of approximately USD 1.18 (NZD 2) per share to its farmer shareholders. For Lactalis, the purchase will significantly expand its market footprint in key regions like Australia and Asia. The transaction, which is subject to approval from Fonterra's shareholders and regulatory authorities, is anticipated to be completed in the first half of 2026.

The United Kingdom's (UK) dairy sector reported significant year-on-year (YoY) export growth in the second quarter of 2025, with total shipment volume increasing by 9.8% to 370,400 metric tons and value rising sharply by 20.5% to USD 794.5 million (GBP 588 million). This robust expansion was primarily fuelled by exceptional performance in key categories. Milk powders experienced the most substantial growth at a 31.1% increase in volume, followed by whey and whey products at 26.5%. Exports of milk and cream saw a substantial 9.4% volume increase, reaching their highest quarterly level in three years. Similarly, cheese and curd exports grew by 5.4% in volume, hitting a five-year quarterly high. In contrast to these gains, export volumes for yoghurt (-25%) and butter (-0.6%) declined. The EU remains the primary destination for UK dairy, absorbing around 90% of total exports. However, cheese exports saw a notable increase to some countries in the Middle-East and Africa (Algeria, Lebanon, Morocco, Saudi Arabia), Asian nations including China, the Philippines, Hong Kong, and Canada. The strong Q2-2025 performance, bolstered by an abundant spring milk supply, signals significant opportunities for UK exporters, particularly in value-added products and emerging international markets.

UK's milk production continued its upward trend in Jul-25, with deliveries increasing by 4.4% YoY to 1,069 million liters. Daily deliveries averaged 34.48 million liters per day. This growth is underpinned by favourable production economics, including a strong milk-to-feed price ratio, which has encouraged farmers to increase yields despite concerns over summer grass growth and future winter forage availability. This surge in supply, however, coincided with seasonally quiet wholesale market activity during the July holiday period. Consequently, prices for key commodities such as butter, skimmed milk powder (SMP), and mild cheddar remained largely stable, showing only marginal month-on-month (MoM) easing. Bulk cream was a notable exception, experiencing a price increase driven by strong seasonal consumer demand for products like strawberries and cream. This market equilibrium was reflected in farmgate prices, with most milk contracts for Aug-25 holding steady, signaling a period of price stabilization across the supply chain.

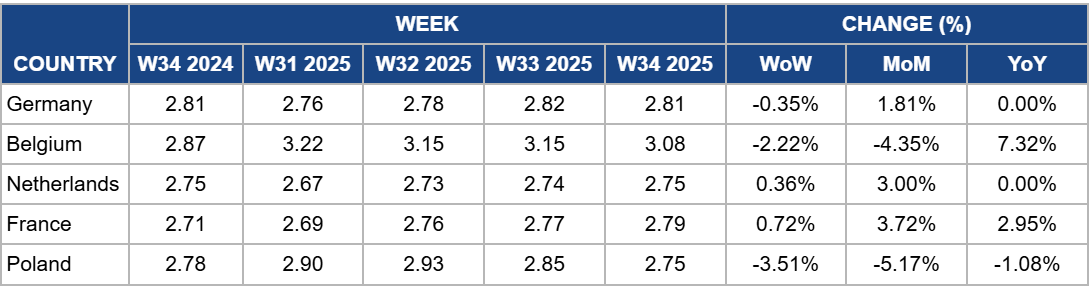

In Germany, the price of SMP was USD 2.81 per kilogram (kg) in W34, a slight decrease of 0.35% week-on-week (WoW). This follows a period of gains, contributing to a 1.81% increase MoM and a stable market with no changes YoY. The minor WoW dip can be attributed to the seasonally quiet market activity typical across Europe in late summer, as holiday periods temper immediate demand and trading volumes. However, the stronger MoM increase reflects the underlying market fundamentals, as the seasonal peak of milk production has passed, leading to a tighter supply of raw milk and supporting prices over the past month. The flat YoY performance indicates a market in balance, where current supply levels are sufficient to meet demand without significant price deviation from the previous year. This stability exists despite growing uncertainty in the export market, particularly surrounding China's extended anti-subsidy probe, which may be tempering potential price increases.

In Belgium, the price of SMP was USD 3.08/kg in W34, down 2.22% WoW and 4.35% MoM, but remained higher 7.32% YoY. The negative WoW and MoM movements signal a market correction driven by lethargic summer holiday demand across Europe. With many buyers absent from the market or purchasing only for immediate needs, sellers are lowering offer prices to stimulate activity, pulling prices down from the highs seen in previous weeks. Despite this recent downturn, the significant YoY increase highlights the persistent underlying supply tightness across the EU, especially in Belgium where SMP production is down 7.9% in the first seven months of 2025. Compared to the same period last year, lower overall milk availability continues to support a higher fundamental price floor for storable dairy commodities. The current price dip is therefore seen as a short-term, demand-side correction within a longer-term, supply-constrained market environment.

In the Netherlands, the price of SMP was USD 2.75/kg in W34, showing a slight increase of 0.36% WoW and a solid 3% rise MoM. The price remained stable YoY with no changes. The market continues to show signs of firming, with the modest WoW increase indicating that prices are holding steady and finding support despite the quiet summer trading period. The stronger MoM performance is a clear reflection of a tightening supply environment as milk availability declines following the seasonal spring flush, providing upward momentum over the past four weeks. The flat YoY price indicates a well-balanced market compared to the previous year, where current supply levels are adequate to meet the subdued summer demand. This stability suggests that while the market is firming MoM, it has not yet seen the significant upward pressure that would lift prices above last year's levels, potentially tempered by broader European market quietness.

In France, the price of SMP was USD 2.79/kg in W34, up 0.72% WoW, a strong 3.72% MoM, and 2.95% YoY. The French market continues to demonstrate a firming trend. The slight WoW increase shows price resilience, pushing against the typically quiet trading conditions of the late European summer holiday period. The more significant MoM increase is a direct consequence of tightening domestic milk supplies. With the seasonal spring production peak now firmly in the past, the reduced availability of raw milk is exerting clear upward pressure on prices compared to a month ago. The positive YoY performance is supported by these same structural supply constraints. A fundamentally tighter raw milk market across the EU compared to the same period in 2024 has established a higher price floor for key dairy commodities.

In Poland, the price of SMP was USD 2.75/kg in W34, a sharp decrease of 3.51% WoW. This continues a downward trend, resulting in a 5.17% decline MoM and a 1.08% decrease YoY. The Polish SMP market remains under significant bearish pressure. The pronounced WoW and MoM declines are driven by a combination of weak seasonal demand during the summer holiday period and a unique domestic supply situation. Unlike many of its EU counterparts, Poland has seen a 1.1% increase in raw milk deliveries in the first seven months of the year. This increased availability of raw material is a key factor weighing on prices. The negative YoY comparison highlights this divergence; while broader EU supply is tight, Poland's relative abundance of milk has pushed prices below the levels seen at the same time last year, even with domestic SMP production being down 6.6%.

The extension of China's anti-subsidy probe creates prolonged and significant risk for EU dairy exporters heavily reliant on this single market. To mitigate the potential impact of future tariffs or trade disruptions, exporters should accelerate their diversification strategies. Especially against the backdrop of the recently introduced 15% tariff by the US. Focus should be placed on high-potential alternative markets identified in the UK's recent export success, such as the Middle East, Africa, and Southeast Asia. These regions show growing demand for value-added dairy products like cheese. Companies should reallocate marketing resources, build relationships with new importers, and adapt product offerings to meet local tastes and preferences in these emerging markets. Proactively reducing dependence on China now will build resilience and safeguard future revenue streams against adverse geopolitical outcomes. This strategy should be viewed not just as a defensive move, but as an opportunity for long-term growth in new regions.

With UK milk production remaining robust, as seen in the 4.4% YoY increase for Jul-25, there is a clear opportunity to convert this supply into higher-margin products for international markets. The Q2-2025 export data provides a precise roadmap: while total volume grew 9.8%, total value surged by an impressive 20.5%, indicating a successful shift toward more profitable exports. The standout performers were dairy powders, whey products, and cheese, all of which recorded significant growth. UK dairy processors should strategically channel their ample milk supply into expanding the production of these specific value-added categories. For exporters, the focus should be on intensifying efforts in the non-EU markets where British cheese is already gaining traction, such as the Middle East, Africa and Asia. By promoting the quality and provenance of British dairy, the industry can capitalize on this momentum, turning strong raw material availability into enhanced profitability and a more resilient position in the global marketplace.

Sources: Tridge, Agriculture and Horticulture Development Board, Reuters, Just Food, Cheese Reporter

Read more relevant content

Recommended suppliers for you

What to read next