News

Original content

In W34, the United States (US) imposed a 50% tariff on Brazilian green coffee imports, disrupting trade flows. US roasters began suspending existing contracts with Brazil, while futures markets responded sharply. Intercontinental Exchange (ICE) Arabica futures rose over 30%, reaching USD 3.74 per pound (lb), as speculative trading intensified amid uncertainty. Reduced Brazilian export volumes, coupled with frost damage reported in key growing regions, raised supply concerns and shifted buyer demand toward Colombia..

Retail Prices Poised to Climb Behind Rising Bean Costs

Meanwhile, raw coffee prices in Brazil surged by nearly 25% in W34, rising to USD 402.96 per 60-kilogram (kg) bag (BRL 2,191/60-kg bag), driven by both tariff-driven futures spikes and on-farm frost fears. Although roasted prices eased earlier this month, rising raw costs are expected to push consumer prices higher soon. This marks a notable turnaround in retail dynamics following recent post-harvest softness.

Colombia recorded 1.37 million 60-kg bags of coffee production in Jul-25, the highest level for that month since 2015, driven by persistent rainfall that delayed flowering into later months, thereby concentrating yields. Over the rolling 12-month period (Aug-24 – Jul-25), total production rose 18% year-on-year (YoY), pushing exports up as well. This significant output offers short-term supply resilience amid regional climate challenges.

Despite recent production gains, the United States Department of Agriculture (USDA) forecasts a 5.3% drop in Colombian coffee production for the 2025/26 cycle, projecting output at 12.5 million 60-kg bags. The decline is attributed to heavy rains disrupting flowering, alongside elevated prices that have dampened replanting investments. This looming contraction could create volatility in supply and pricing next harvest season.

Vietnam’s coffee sector delivered a stellar performance in the first half of 2025 (H1-2025), with export volume reaching 953,900 metric tons (mt), a 5.3% YoY increase. Additionally, export value skyrocketed 67.5% YoY to USD 5.45 billion, already surpassing full-year targets. Rising global demand for quality Robusta and growth in key markets like Germany, Italy, and Spain underpin this surge, signaling strong price realization for exporters.

Building on H1 gains, market analysts expect Vietnam’s coffee export revenue to reach USD 7.5 billion by the end of 2025, well above earlier estimates. That translates to a potential 37% YoY increase, reinforcing Vietnam’s role in global coffee trade, supported by processing upgrades, strong demand, and market diversification.

.png)

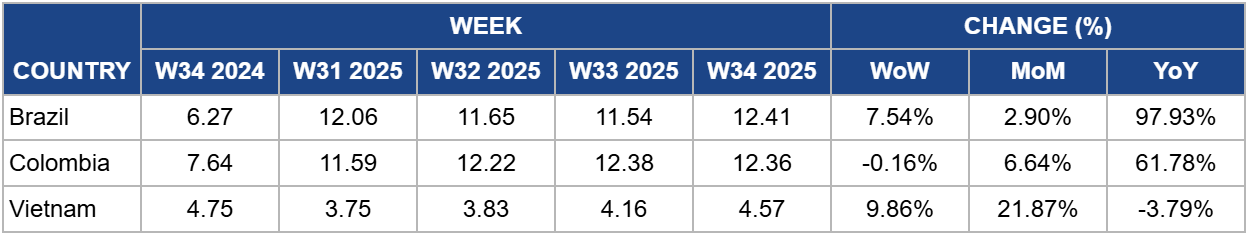

In W34, Brazilian domestic wholesale coffee prices rose by 7.54% week-on-week (WoW) to USD 12.41/kg. Prices have remained elevated throughout most of the year, surging by 97.93% YoY. Rising New York ICE futures and the 50% US tariff are providing support to domestic quotations.

Looking toward W35, domestic prices are expected to stabilize, provided harvesting and logistic activity remain uninterrupted. If ICE futures maintain gains or currency fluctuations occur, there could be upward pressure; otherwise, ample supply should keep a lid on volatility.

In W34, Colombian coffee prices remained stable at USD 12.36/kg, down 0.16% WoW. Despite this, prices remain relatively elevated, up 61.78% YoY. Wholesale prices have trended modestly higher this week, reflecting stronger futures and steady internal demand. Additionally, according to the Federación Nacional de Cafeteros (FNC), the current domestic reference price is approximately USD 706.51/125-kg load (COP 2,865,000/125-kg load), closely linked to ICE futures (near US¢ 356/lb) and the peso-dollar exchange rate.

In W35, prices are expected to hold or edge up slightly, if benchmarks and exchange rates stay stable. Shifts in ICE futures or peso strength could influence the FNC reference and impact farmgate pricing for growers.

In W34, wholesale coffee prices in Vietnam remained elevated, up 9.86% WoW at USD 4.57/kg. This bullish trend has persisted all month, with prices up 21.87% month-on-month (MoM) owing to premium quality beans and limited supply.

Looking ahead to W35, domestic prices are forecast to remain firm within the current range, given limited farm supply and strong Robusta demand. Unless there’s a sharp shift in global robusta futures or new crop arrivals, price stability is expected.

With Brazilian Arabica prices softening while global futures remain firm, exporters and roasters should make greater use of hedging tools like ICE futures or options to lock in prices. This approach will help mitigate the risks posed by currency fluctuations and evolving tariff dynamics that are reshaping Brazil’s export flows. By locking in forward prices, traders can stabilize margins despite market uncertainty. Additionally, exporters should review their pricing models to incorporate tariff-related costs, ensuring they remain competitive in key importing markets. This proactive approach will provide greater predictability in revenue streams and reduce exposure to short-term volatility.

In Colombia and Vietnam, where wholesale prices remain firm amid stable demand and tight spot supply, industry players should reassess inventory strategies to balance cost and availability. Importers should secure volumes early through forward contracts or staggered buying to avoid price spikes. In turn, exporters can leverage the current stability to negotiate longer-term supply agreements with buyers, ensuring consistent cash flows. Maintaining adequate stock levels will also help buffer against logistical disruptions, particularly as weather and geopolitical risks continue to influence global trade dynamics. This strategic planning can safeguard operations and maintain profitability even in volatile conditions.

With demand for specialty and premium-grade coffee gaining momentum in major consumer markets, producers and exporters in Brazil, Colombia, and Vietnam should invest in quality upgrades and certifications to capture higher-margin segments. Initiatives such as implementing traceability programs, obtaining sustainability certifications, or improving post-harvest processing can differentiate offerings and attract premium buyers. By positioning their beans in niche markets, suppliers can reduce reliance on volatile commodity pricing and build stronger, more resilient partnerships with specialty roasters. This strategy boosts profits and meets consumer demand for quality, sustainability, and transparency.

Sources: Tridge, International Comunicaffe, Qahwa World, Food Business MEA, Cinco Dias, Reuters, AHCHAM Colombia, The Star, Vanguard Business International

Read more relevant content

Recommended suppliers for you

What to read next