Original content

The Brazilian Sugarcane Industry Association (Unica) reports that Centre‑South cane crushing rose 9% year-on-year (YoY) through late May-25, signaling strong momentum in processing that supports Brazil's National Supply Company’s (Conab) projection of near-record 45.9 million metric tons (mmt) output in 2025/26. Meanwhile, American financial services company StoneX estimates crushing will reach 598.8 mmt of cane despite slight weather-related declines from last year, both pointing to a very tight sweetener pipeline and continued expansion in sugar availability

A global sugar glut is being priced in, with the Intercontinental Exchange (ICE) No. 11 futures falling to four-year lows close to US¢ 16 per pound (lb) amid bearish production expectations, notably from India and Brazil. Supply-side sentiment is further amplified by rising Brazilian sugar-to-ethanol ratios as mills prioritize sweetener production over biofuel, intensifying downward price pressure.

The Indian Sugar Mills Association (ISMA) projects sugar production to rise 18% to 34.9 mmt in 2025/26, citing a strong monsoon and expanded planted area. To manage this surplus, the association has called for export permits of up to 2 mmt and diversion of 5 mmt toward ethanol blending.

The Indian government allowed 1 mmt of sugar exports this season, with shipments already reaching 600,000–700,000 metric tons (mt). While second export tranches may follow, current contracts reflect cautious engagement by international buyers, given price sensitivity and logistical barriers.

The United States Department of Agriculture (USDA) forecasts confirm a rebound to 5.05 mmt of sugar supply in 2025/26, driven by improved climatic conditions and acreage recovery after extended drought cycles. Yet, mill-level profitability remains challenged, and output gains have not triggered price rallies or export acceleration.

Ethanol Diversification and Quality Upgrading Slowly Evolve

Mexico continues exploring sugarcane-to-Sustainable Aviation Fuel (SAF) and organic certification pathways to add value to the sector. However, market observers note that while quality and sustainability positioning strengthen over time, near-term pricing impact remains minimal given persistent export constraints and inertia in policy execution.

The federal cabinet approved the import of 500,000 mt of sugar through public and private channels to stabilize consumer prices hovering near USD 0.63-0.67 per kilogram (PKR 180–190/kg). As local stocks remain depleted post-export surge, officials aim to complete import formalities within weeks to prevent further hardship.

Pakistan’s import policy reversal, following prior high-volume exports, has drawn severe criticism from analysts and the International Monetary Fund (IMF). Meanwhile, allegations of coordinated hoarding among mill owners have prompted a regulatory probe, raising uncertainty in pricing and supply chains.

Even as global sugar benchmarks weaken, United States (US) ICE futures have held firm at US¢ 16.3/lb, buttressed by the Tariff-Rate Quota (TRQ) system, which limits new sugar arrivals. Limits on specialty and raw sugar imports keep domestic availability tight, insulating local prices from rapid global drops.

Projected US sugar supply for 2025/26 reached 13.808 million Short Tons Raw Value (STRV), buoyed by beginning stocks and steady beet production, though beet and cane output dipped slightly. Refined prices remain steady at US¢ 55–60/lb Free-on-Board (FOB), reflecting a balanced market without major disruptors in production, policy, or logistics.

.png)

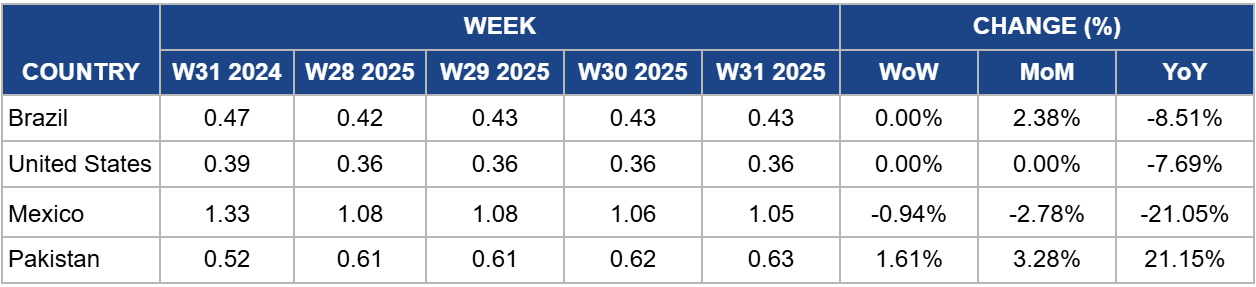

In W31, wholesale sugar prices in Brazil remained flat for the third week straight at USD 0.43/kg. This stability reflects ample domestic availability and the impact of robust cane crushing. Despite global oversupply concerns pushing ICE futures lower, domestic pricing remains relatively stable due to subdued local demand and logistical flow.

Wholesale prices will remain stable in W32, or potentially dip modestly if crushing continues apace and export bid strength fails to materialize. However, any delays in milling or regional weather disruptions could tighten domestic availability and support slight price gains.

In W31, refined sugar wholesale prices in the US exhibited flatness for the fourth week in a row at USD 0.43/kg. This stability comes despite international volatility, thanks to tight supply controls, including TRQs and steady beet/cane output, and prices staying elevated relative to world benchmarks. Additionally, domestic stock levels remain firm, preventing a steep price decline.

Market players should expect domestic wholesale prices to remain stable in W32, barring any unexpected weather events or import license announcements. Unless TRQ allocations expand or distribution disruptions emerge, market participants can expect continued equilibrium in the refined sugar space.

Wholesale sugar in Mexico has remained relatively stable at USD 1.05/kg in W31, a 0.94% week-on-week (WoW) decline and 2.78% month-on-month (MoM) drop. Price stability reflects improving domestic output without meaningful shifts in export flows or trading sentiment. Although inventory is stabilizing, logistical constraints and limited imports continue to cap any rapid price movement.

Wholesale sugar in Mexico has remained relatively stable at USD 1.05/kg in W31, a 0.94% week-on-week (WoW) decline and 2.78% month-on-month (MoM) drop. Price stability reflects improving domestic output without meaningful shifts in export flows or trading sentiment. Although inventory is stabilizing, logistical constraints and limited imports continue to cap any rapid price movement.

In W31, wholesale sugar prices in Pakistan rose by 1.61% WoW. YoY prices exhibit a stronger upward push, rising by 21.15%. This spike reflects persistent supply scarcity and slow-moving government imports. Market sentiment remains tight, and hoarding behavior continues to amplify pricing volatility.

As duty-free imports begin clearing ports, wholesale prices may ease, but relief may be gradual. Persistent supply constraints and delayed logistics could keep price levels elevated unless import flows accelerate and anti-hoarding measures are effective.

The recent sharp upward movement in wholesale sugar prices in Pakistan, driven by persistent supply shortages and uncertainty around import policy, requires industry players to adopt more robust risk management strategies.

To mitigate exposure to these volatile price swings, traders, refiners, and large-scale buyers should increase reliance on diversified sourcing channels, including short-term contracts with regional suppliers in countries like India, Thailand, or the United Arab Emirates (subject to trade policy shifts).

Additionally, implementing hedging instruments, where available (such as commodity swaps or futures linked to global benchmarks), can help businesses lock in acceptable price levels.

Maintaining strategic inventory buffers during harvest season or periods of anticipated supply inflows will also allow producers to maintain supply chain stability and reduce margin erosion during tight supply periods.

In Brazil and the US, sugar prices have remained comparatively stable over the past week, supported by adequate harvest yields and steady demand from the industrial and retail sectors. This price environment presents a window of opportunity for downstream players, such as food processors, beverage companies, and confectioners, to lock in supply through forward contracts or fixed-price agreements.

Doing so would allow buyers to protect themselves from anticipated cost increases later in the year due to weather variability, fuel cost inflation, or possible changes in global ethanol-sugar market dynamics (especially in Brazil).

Furthermore, buyers with seasonal production spikes, such as soft drink producers in Q4-25, can use current stability to secure better terms, avoiding price spikes that may emerge if global prices rally or domestic inventories fall short.

Mexico’s sugar market is currently stable, but it is highly sensitive to export quotas and US import policies, including potential revisions to the US-Mexico suspension agreement or annual TRQ allocations.

Exporters and traders should closely monitor government statements, USDA quota releases, and bilateral trade developments to identify emerging opportunities for profitable short-term arbitrage, especially if US spot prices rise on import shortfalls or refinery outages.

This is particularly relevant for Mexican mills and logistics companies with access to export infrastructure. Being ready with logistics contingencies and pre-approved trade documentation can enable faster response to such trade windows, allowing suppliers to take advantage of pricing gaps before they close.

Sources: Tridge, Business Insider, ISO Sugar, Brazilian Sugar Exporters, McKeany-Flavell, CMB News, Daily Magazine

Read more relevant content

Recommended suppliers for you

What to read next