Original content

Argentina's recent reduction in soybean export duties from 33% to 26% signals a permanent shift in policy, aiming to improve profitability for producers. However, despite the cut, soybean production on rented fields remains unprofitable, with average losses still exceeding USD 59 per hectare (ha). Market prices have already priced in the announcement, limiting any immediate price gains. Producers hold 30 million tons of unsold grain, and potential sales under the new tax scheme could reduce state revenue by USD 530 million. While the sector welcomes the move, further cuts are needed to restore competitiveness, especially ahead of the Oct-25 planting season.

Paraguay is set for a record-breaking soybean seed plan for the 2025/2026 agricultural season, according to the executive director of the Paraguayan Seed Producers Association (Aprosemp). The planted area for seed production has surged to a record 90,970 ha, a significant increase from 70,000 the previous year. This expansion is projected to yield an unprecedented 1.8 to 2 million bags of seeds, far exceeding previous outputs.

The growth also includes a record 99 different soybean varieties being grown. Despite this significant expansion in the formal seed sector, the executive director noted that the adoption rate of certified seeds by farmers remains low at around 40%, facing persistent competition from the illegal market. This highlights a substantial push for future production potential alongside ongoing challenges in formalizing the agricultural supply chain.

Venezuela is preparing to impose tariffs on products from Brazil and other Mercosur nations as it seeks reinstatement into the trade bloc. The country plans to adopt the Mercosur Common External Tariff (TEC), which will end the current duty-free access for Brazilian goods and apply an average duty of 7.7%.

This policy will significantly impact key Brazilian agricultural exports, with proposed tariffs of 8% on soybeans and corn, 6% on soybean meal, and 10% on beef. The move comes as Brazilian exports to Venezuela are growing, having reached USD 669 million in the first half of 2025 (H1-2025), a 22% increase from the previous year. The measure is a critical step in Venezuela's effort to normalize its trade relations and reintegrate into the regional economic bloc.

.png)

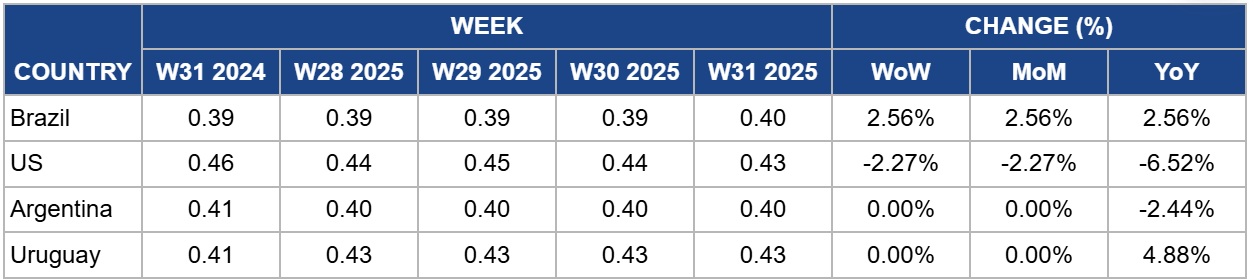

In W31, Brazilian soybean prices rose by 2.56% week-on-week (WoW) to USD 0.40 per kilogram (kg). Prices also showed the same percentage increase MoM and YoY, reflecting a synchronized upward trend. Although Brazil's harvest is complete, the market remains closely tied to international movements. The gains, however, were limited by a strengthening real, which continues to weigh on export competitiveness.

Brazilian soybean prices broke out of a month-long stagnation, driven not by local factors but by a weather-fueled rally in US Chicago futures. The external momentum pulled the domestic market higher.

Still, farmer selling remains slow and cautious. While international prices have improved, a strengthening real is cutting into dollar-denominated returns. With high input costs ahead of the 2025/26 planting season, producers are holding out for better margins.

In W31, United States (US) soybean prices dropped by 2.27% WoW to USD 0.43/kg as a direct result of the previous United States Department of Agriculture (USDA) Weekly Weather and Crop Bulletin indicating that 70% of the soybeans were rated as good to excellent, a two percentage point increase from a week earlier. On a similar pattern, prices remained similar to last month at USD 0.44/kg in W28, with only a slight decrease of 2.27% MoM.

On the other hand, the more prominent YoY price drop of 6.52% reflects a broader trend of a well-supplied global market and robust domestic stock levels. Last year's prices were higher amid greater uncertainty, reaching USD 0.46/kg. In contrast, the current production forecast of soybean production in the US remains solid, along with positive indications for competitor nations like Brazil. This solid supply, coupled with competition for export sales, continues to weigh on prices compared to the same period last year.

In W31, Argentine soybean prices remained steady at USD 0.40/kg, with no change on a weekly or monthly basis, but 2.44% lower YoY. The market is effectively frozen, not due to normal supply and demand, but because of a standoff between farmers and the government. Many producers are holding back their harvest, waiting for a possible cut in export taxes. This has tightened local supply, keeping prices from falling further. However, it has also caused Argentina to miss out on the recent global price rally. The YoY decline highlights the impact of strong global supply, which continues to weigh on prices.

In W31, Uruguay’s soybean prices held steady at USD 0.43/kg, with no change on a weekly or monthly basis, but showing a 4.88% increase YoY. Despite global market volatility, this stability reflects Uruguay’s solid position. Unlike Argentina, where prices are stalled due to policy uncertainty, Uruguay’s firmness is supported by a successful harvest and steady export demand. The YoY gain highlights the country’s reputation as a reliable, premium supplier. As weather and policy risks rise in other major producers, buyers continue to show confidence in Uruguayan soybeans, helping sustain higher prices throughout the year.

With the recent export duty reduction failing to make soybean production profitable on rented land, Argentina must move beyond tax policy and address core financial viability. Producers currently holding 30 million tons of grain should leverage this stored inventory as collateral to secure favorable financing for the upcoming, more profitable corn season. Concurrently, policymakers should work with financial institutions to create targeted credit lines for soybean farmers, specifically designed to offset high input costs. This dual strategy will empower farmers to pivot to corn where profitable while providing a lifeline to sustain the soybean sector, ensuring the tax cut is a stepping stone to recovery, not just a reduction in losses.

Paraguay's record investment in soybean seed production will only be realized if the gap between potential and on-farm use is closed. With the adoption of certified seeds languishing at 40% due to the illegal market, Aprosemp and the government must launch a joint initiative to formalize the supply chain. This should include government-backed financing programs that offer preferential rates to farmers who purchase certified seeds, making the legitimate option more economically attractive. Simultaneously, more vigorous enforcement and penalties against the illegal seed trade are crucial. This will ensure the nation's significant investment in advanced genetics translates into higher national yields, improved crop quality, and greater export value.

Brazilian exporters face a direct threat from Venezuela's plan to impose an 8% tariff on soybeans as it rejoins Mercosur. To counter this, exporters must act immediately to secure sales contracts with Venezuelan buyers before the new duties are implemented, locking in current duty-free prices. Simultaneously, a strategic pivot is essential. Export agencies and producers should aggressively target alternative markets in the Caribbean and Central America that have growing import needs. By diversifying their buyer portfolio now, Brazilian exporters can mitigate the financial impact of the new tariff and reduce their long-term reliance on the increasingly costly Venezuelan market.

Sources: Tridge, Productiva, Agromeat, Canalrural

Read more relevant content

Recommended suppliers for you

What to read next