Original content

A new trade agreement between the European Union (EU) and the United States (US) has capped tariffs on most EU exports at 15%, averting the threat of a much higher 30% duty. While this brings welcome stability to the dairy sector, the new rate places European exporters at a significant competitive disadvantage against rivals from New Zealand, Australia, and the UK, who enjoy lower or zero tariffs. The 15% levy is a particular concern for high-value products like Irish butter and French and Italian specialty cheeses, which now face a larger price gap on US shelves. The tariff regime could slow EU dairy export growth to the US by 1–2% in 2025, according to preliminary estimates. In response, the EU dairy industry is expected to accelerate its diversification strategy, diverting more volumes to growing markets in Asia, the Middle East, and Africa. This strategic shift could, in turn, put downward pressure on global commodity prices.

A landmark partnership between the Algerian Government, Qatari food producer Baladna, and German technology provider GEA is set to create the world's largest integrated dairy farm and milk powder facility. This monumental project aims to drastically reduce Algeria's dependence on foreign markets, as the nation is currently the world's third-largest importer of milk powder. Construction will commence at the beginning of 2026 while milk powder production is planned to commence in late 2027, with gradual scale-up of production volumes over subsequent years. Once fully operational, the state-of-the-art facility is projected to have a final capacity of approximately 100,000 metric tons (mt) of milk powder per year. This massive output is planned to meet about 50% of Algeria's national milk powder needs, create 5,000 local jobs, and mark a major milestone in the country's food security strategy.

The lumpy skin disease (LSD) outbreak in France is escalating, with 51 outbreaks now confirmed and approximately 1,000 cattle culled since the first case was detected in late Jun-25. The viral illness, which reduces milk production, is spreading rapidly, prompting an emergency response from the farm ministry, including a vaccination campaign that has already covered around 100,000 cows since its launch on July 19. The outbreaks are concentrated in key cheese-producing regions like Savoie and Haute-Savoie, raising significant economic concerns for famous products such as Reblochon and Beaufort. The situation is already impacting international trade, with the United Kingdom (UK) and other countries banning imports of raw milk cheese from France. With the largest cattle herd in the EU at 17 million, the rapid spread of LSD poses a serious threat to the stability of the French dairy sector.

Australia's Bega Cheese has partnered with Dutch dairy giant FrieslandCampina to launch a joint bid for a significant portion of Fonterra’s Oceania consumer and foodservice businesses. The proposal, which targets iconic brands such as Anchor, Mainland, and Western Star, would see Bega acquire the Oceania assets while FrieslandCampina would take over the international segments. This move places the consortium in direct competition with other major players, including French giant Lactalis, for the valuable assets. The Australian Competition and Consumer Commission (ACCC) has initiated a thorough review of the bid, focusing on its potential impact on competition for raw milk purchasing in Victoria and Tasmania. Industry stakeholders have a submission deadline of August 15, 2025, and the ACCC aims to release its findings by September 25, 2025. While the bid signals a major potential shift in the region's dairy landscape, it faces significant hurdles, including ongoing legal disputes between Bega and Fonterra over brand licensing.

Leading Dutch dairy cooperative FrieslandCampina has announced a decrease in its guaranteed milk price for August 2025, lowering it by USD 0.58 (EUR 0.50) to USD 65.5 per 100 kilograms (EUR 56.25/100kg). This adjustment reflects the company's expectation that reference prices from other Northwest European dairy companies will soften, in line with recent developments in the commodity dairy market. The Integral Milk Price, which includes sustainability and other bonuses, will be USD 69.23/100kg (EUR 59.46/100kg) for conventional milk. This price is a key indicator of the compensation that member farmers can expect. The move signals a slight cooling in the European dairy market after a period of price strength, as processors adjust to evolving supply and demand dynamics for bulk dairy commodities.

FrieslandCampina has reported strong financial results for the first half of 2025, with revenue increasing by 6.4% to USD 7.92 billion (EUR 6.8 billion) and net profit rising 25.7% to USD 267.81 million (EUR 230 million). The positive performance was driven by higher selling prices and strong results in its Specialised Nutrition and Ingredients business groups, despite lower volumes. Despite the strong first half, the company has issued a cautious outlook for the remainder of the year, warning of significant headwinds. FrieslandCampina expects profitability to come under pressure due to low global consumer confidence, unfavorable currency developments, and a softening in commodity dairy markets. This cautious forecast aligns with the company's recent decision to lower its guaranteed milk price for August, signaling a more challenging market environment ahead.

New Zealand's 2025/26 dairy season has started with unexpected strength, as Jun-25 milk production surged by a remarkable 17.8% year-on-year (YoY). This powerful opening, which follows last season's 3.0% growth, the strongest in over a decade, sets a positive tone for the months ahead. The market signal for expansion is significantly stronger this year, with Fonterra's opening milk price forecast at USD 5.96 per kilogram of milk solids (kgMS) (NZD 10/kgMS), a substantial increase from last year's USD 4.77/kgMS (NZD 8/kgMS opening). This high price is incentivizing farmers to maximize output, leading to an 8% reduction in winter cow cull numbers as older cows are kept in production longer. On-farm conditions are also excellent, with strong winter pasture growth providing a critical feed buffer, particularly in regions like Waikato and Taranaki, which are recovering from earlier drought. This is further supported by a 34% increase in palm kernel expeller imports and strong herd reproduction metrics. While weather remains a key variable, the sector is well-positioned for another year of growth, with forecasts predicting a 1-3% increase. If this materializes, it would mark a second consecutive year of high prices and high output for the New Zealand dairy sector.

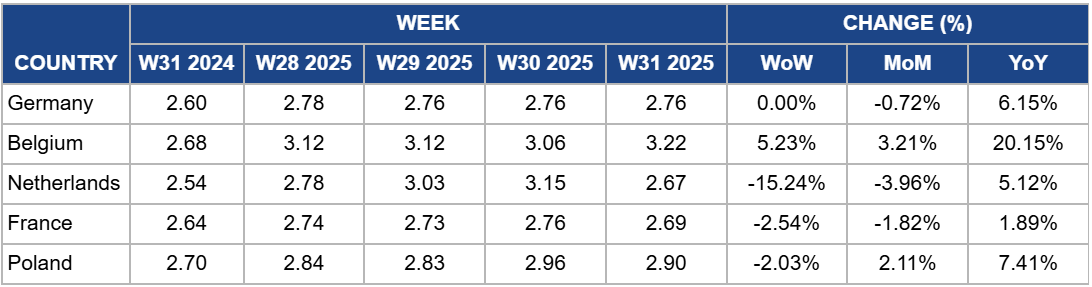

In Germany, the price of Skimmed Milk Powder (SMP) was USD 2.76/kg in W31, stable week-on-week (WoW). The price is down 0.72% month-on-month (MoM) but remains up a significant 6.15% YoY. The German SMP market has found a stable equilibrium, with short-term seasonal supply balancing out long-term tightness. The WoW stability and slight MoM decrease reflect a market that has fully absorbed the peak of the spring/summer milk flush. This has provided sufficient raw material for processors, easing the upward price pressure seen earlier in the season and leading to a slight correction. However, the dominant long-term trend remains the 6.15% YoY price increase. This is a direct consequence of the structural supply constraints facing the EU dairy sector, including reduced cattle herds from disease and drought. These factors have fundamentally tightened the raw milk market compared to last year, keeping the cost of producing storable commodities like SMP at a significantly elevated level.

In Belgium, the price of SMP was USD 3.22/kg in W31, a sharp increase of 5.23% WoW. This contributes to a 3.21% MoM rise and a significant 20.15% increase YoY, marking the highest price level in the past year and the highest among top EU-producing countries. The Belgian SMP market is experiencing a strong bullish rally, with prices surging to a yearly high. The sharp weekly and monthly increases are a direct result of the tightening raw milk supply across the EU. As the seasonal production peak has passed, the underlying supply constraints—caused by smaller cattle herds due to disease, drought, and the ongoing trend of farm consolidation—are becoming more acute, driving up input costs for processors. The production of SMP in Belgium is also down 11.2% in H1-25, contributing to the elevated prices. The significant 20.15% YoY increase underscores the long-term impact of these supply shocks. With EU milk production forecast to stagnate, the fundamental scarcity of raw milk compared to the same period last year is the primary driver supporting the significantly elevated price for storable commodities like SMP.

In the Netherlands, the price of SMP was USD 2.69/kg in W31, a sharp decrease of 15.25% WoW. This contributes to a 3.96% MoM decline, though the price remains up 5.12% YoY. The Dutch SMP market has experienced a significant bearish correction after a price spike in the previous week. The dramatic WoW drop suggests a market overreaction to earlier supply concerns, which is now recalibrating as the tail-end of the seasonal milk flush provides sufficient raw material for processors. This has eased immediate upward pressure and pushed prices down on a monthly basis. However, the dominant long-term trend remains the 5.12% YoY price increase. This reflects the fundamental supply tightness across the EU, where reduced cattle herds from disease and environmental pressures have constrained overall milk production. The Dutch dairy herd was particularly affected by the bluetongue virus outbreak, and this underlying scarcity of raw milk continues to support a higher price floor compared to the same period last year.

In France, the price of SMP was USD 2.69/kg in W31, a decrease of 2.54%WoW and 1.82% MoM. However, the price remains up 1.89% YoY. The French SMP market continues to soften in the short term, reflecting a typical summer slowdown and the tail-end of the seasonal milk production peak. The weekly and monthly price declines indicate that there is currently sufficient raw milk available for processors, which has eased the upward price pressure seen earlier in the season. This has allowed the market to correct from its previous highs. However, the YoY price increase, though modest, highlights the underlying tightness in the European milk supply. Structural constraints, including a smaller national herd and the recent Lumpy Skin Disease outbreak, mean that the overall supply of raw milk is lower than it was at the same time last year, albeit only down 0.8% for both raw milk and SMP in H1-25. This fundamental scarcity continues to support a higher price floor for storable commodities like SMP compared to 2024 levels.

In Poland, the price of SMP was USD 2.90/kg in W31, a decrease of 2.03% WoW. The price is up 2.11% MoM and remains up a significant 7.41% YoY. The Polish SMP market is experiencing mixed short-term signals while maintaining a strong YoY price increase. The WoW drop is likely a minor correction reflecting the broader summer slowdown in European trading. However, the MoM price increase is driven by a key domestic factor: while Poland's raw milk production was up slightly in the first half of the year, its SMP production fell by 6.7% during the same period. This reduction in powder output has created domestic scarcity, supporting prices over the past month. The significant 7.41% YoY price increase highlights the impact of the EU's structural supply constraints. Although Poland's milk production is bucking the negative trend seen in Western Europe, it is not enough to offset the continent-wide tightness, keeping commodity prices well above 2024 levels.

European exporters, particularly those specializing in high-value products like French and Italian cheeses, must immediately implement a dual strategy to counter the new 15% US tariff. Firstly, accelerate market diversification efforts by redirecting volumes away from the US towards growing consumer markets in Asia, the Middle East, and Africa, where products will not face the same tariff disadvantage. Secondly, for the portion of business remaining in the US, exporters must reinforce the premium value proposition of their products to justify the higher price point to consumers. This involves investing in targeted marketing that emphasizes authenticity, provenance (e.g., Protected Designation of Origin), unique production methods, and superior quality attributes that differentiate EU products from lower-tariff competitors from New Zealand and Australia. This approach helps defend market share by turning a simple price increase into a clear feature of a premium, sought-after product.

The plan to build the world's largest dairy facility in Algeria signals a fundamental, long-term disruption for milk powder exporters. As the world's third-largest importer, Algeria's move towards 50% self-sufficiency by the end of the decade requires an immediate strategic re-evaluation from its suppliers. Exporters should quantify their current dependence on the Algerian market and begin a proactive, multi-year strategy to cultivate alternative growth markets, focusing on regions with rising populations and incomes, such as Sub-Saharan Africa and Southeast Asia. To maintain a commercial relationship with Algeria, exporters should consider shifting their business model from a bulk commodity supplier to a value-added partner, offering specialized ingredients, technical expertise, or logistical support to their emerging domestic industry. Failing to adapt now will risk significant oversupply and price collapses when this massive new facility comes online.

With the ACCC review of the Bega/FrieslandCampina bid for Fonterra's assets underway, immediate action is required. The submission deadline for stakeholders is August 15, 2025, which is next week. All affected parties, including dairy farmers in Victoria and Tasmania, competing processors, and industry groups, must urgently analyze the potential impact of this merger on competition for raw milk purchasing and prepare a formal submission to the ACCC. This is the critical window to voice concerns or support to influence the outcome. Proactive engagement is essential to ensure a competitive market structure is maintained. Following the submission, stakeholders must closely monitor the ACCC’s findings, due by September 25, 2025, to prepare their business strategies for the potential new market landscape resulting from this major industry consolidation.

Sources: Tridge, Rural News Group, FrieslandCampina, Farmers Weekly, Reuters, GEA, Dairy Dimension

Read more relevant content

Recommended suppliers for you

What to read next