Original content

The Food and Agriculture Organization (FAO) Sugar Price Index declined by 5.2% month-on-month (MoM) in Jun-25 to 103.7 points, marking its fourth consecutive monthly drop and the lowest level since Apr-21. The decrease is attributed to improved supply prospects in key producing countries. In Brazil, favorable weather accelerated harvesting and increased sugar output, while strong early monsoon rains and expanded plantings in India and Thailand boosted expectations for the 2025/26 season. Despite the sugar decline, the overall FAO Food Price Index rose by 0.5% MoM in Jun-25, driven by gains in dairy, meat, and vegetable oil prices.

The European Union (EU) has reduced Ukraine's sugar import quota to 100,000 metric tons (mt) for the current trade period, a sharp drop from over 500,000 mt in the 2023/24 marketing year (MY). This move is part of broader quota adjustments aimed at alleviating pressure on EU farmers facing competition from Ukrainian agricultural products. While barley and poultry quotas were moderately adjusted, the cut in sugar imports is expected to significantly impact Ukrainian exporters already burdened by war-related challenges and high logistics costs. The new quotas remain subject to approval by a qualified majority of EU member states, with a review set for 2028.

Argentina Opposes Brazil's Push to Liberalize Sugar Trade Within Mercosur Over Competitive Imbalance Concerns

Argentina's sugar industry has firmly rejected Brazil's proposal to include sugar in the Mercosur customs union, warning it would cause "serious harm" to the Northwestern Argentine economy. Industry groups argue that Brazil's sugar sector benefits from decades of state subsidies under programs like the National Alcohol Program (Proálcool), creating artificial competitive advantages through subsidized ethanol production, preferential financing, and cross-subsidies.

Argentine producers stress that opening the sugar market under such unequal conditions would undermine local competitiveness, threaten jobs, and disrupt regional development. They cite existing Mercosur provisions recognizing asymmetries and justify maintaining tariffs and trade measures to protect the domestic sector from long-standing distortions in Brazil's sugar market.

Crystal sugar prices in São Paulo's spot market have remained around USD 20.92 per 50-kilogram (kg) bag (BRL 116/50-kg bag) since early Jul-25, according to the Center for Advanced Studies on Applied Economics (CEPEA). Despite global sugar surplus forecasts for the current and upcoming harvests, mills have maintained firm pricing. However, concerns are rising over production costs as the Cepea-Luiz de Queiroz College of Agriculture (CEPEA-Esalq) Indicator for crystal sugar (Icumsa 130–180) recorded a 12.71% MoM decline in Jun-25, reflecting weakening domestic market conditions.

India's sugar industry, once a major contributor to the ethanol blending program, is facing declining ethanol demand due to a policy shift favoring grain-based feedstocks. Molasses-based ethanol, which previously accounted for 70% of the supply, now comprises only 30%, impacting industry revenues, loan servicing, and payments to farmers.

Industry leaders warn that reduced ethanol quotas threaten the viability of recent infrastructure investments made under earlier policy expectations. They urge a restoration of the 55% ethanol share for the sugar sector, especially with a strong sugarcane crop forecast. Without strategic policy realignment, the sector risks overdependence on sugar, reduced diversification, and underutilization of capacity, posing long-term challenges to sustainability.

The 2024/25 crop year in Vietnam has ended with sugar inventories reaching an unprecedented 70% of total output, despite lower domestic prices averaging USD 0.72/kg (VND 18,898/kg). Consumption remains sluggish, largely due to widespread smuggling of cheaper sugar and the growing substitution of cane sugar with imported high-fructose corn syrup (HFCS), which now increasingly dominates the food and beverage industry.

Unable to compete with smuggled sugar priced around USD 0.67/kg (VND 17,400 to 17,600/kg), domestic producers are selling at a loss, risking cash flow and debt repayment to farmers. Although the government has issued multiple directives to combat smuggling and trade fraud, their effectiveness remains limited. Experts urge stricter enforcement, support mechanisms for domestic consumption, and longer-term strategies including market repositioning and expanded use of cane sugar in value-added processing. The crisis threatens not only the viability of sugar enterprises but also the livelihoods of 22,500 farming households and the sustainability of 180,000 hectares (ha) of sugarcane cultivation.

.png)

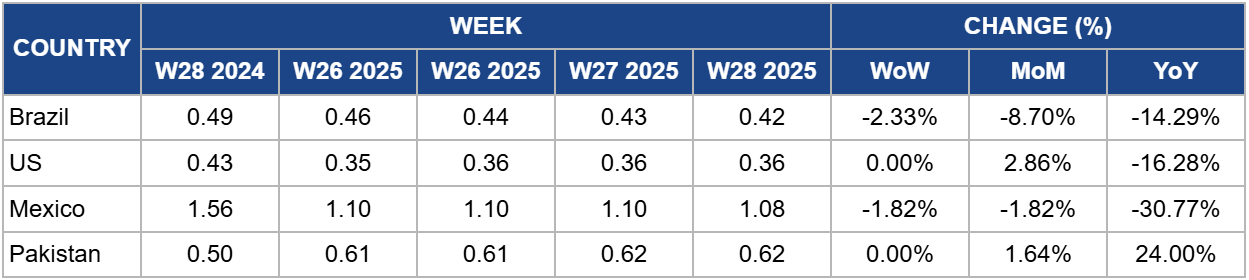

In W28, Brazil's sugar prices fell by 2.33% week-on-week (WoW) to USD 0.42/kg, extending a 14.29% year-on-year (YoY) decline from USD 0.49/kg. This downward trend is reinforced by favorable weather conditions in key producing regions, reducing crop loss concerns. In Brazil, lower frost risk in the sugarcane belt eased supply fears.

Domestically, while the CEPEA-Esalq Index showed a slight rise in crystal sugar prices USD 21.16 per 50-kg bag (BRL 117.44/50-kg bag), an increase of 0.61% WoW. If favorable weather persists and global supply expectations strengthen, Brazil's sugar prices may continue facing downward pressure, potentially challenging margins and export competitiveness in the near term.

US sugar prices held steady at USD 0.36/kg in W28, showing no weekly change but reflecting a 16.28% YoY decline from USD 0.43/kg. The stability in spot pricing contrasts with broader structural shifts in the domestic market, notably the expansion of the National Sugar Marketing Cooperative (NSM).

NSM announced the integration of Western Sugar Cooperative alongside existing members Amalgamated Sugar and Southern Minnesota Beet Sugar Cooperative (SMBSC). This move broadens NSM's geographic reach across key beet-producing regions, Idaho, Minnesota, Colorado, and Wyoming, and is expected to enhance logistical efficiency and reduce operational costs through economies of scale.

While the consolidation may strengthen NSM’s ability to compete with major players like United Sugar Producers and Refiners, it has raised concerns among buyers about reduced sourcing options in an already concentrated United States (US) sugar market. Over time, this may tighten supply-side dynamics, particularly if disruptions or regional imbalances occur.

Mexico's sugar prices declined by 1.82% both WoW and MoM to USD 1.08/kg in W28, marking a significant 30.77% YoY decrease from USD 1.56/kg. This steep decline reflects broader market pressures but may be challenged going forward by worsening pest-related supply constraints.

In Veracruz, a stem-boring screwworm has severely impacted sugarcane fields, leaving behind a destructive fungus that kills the plant from the root. Producers supplying two mills have reported the loss of several ha, with efforts to control the infestation proving ineffective. The damage is particularly acute as it not only reduces current yields but also threatens future crop cycles.

While prices remain under pressure due to weakened demand or overcapacity, this escalating biological threat may reverse the trend if crop losses intensify. A continued decline in production could tighten domestic supply, potentially leading to upward price adjustments in the coming months. The situation also raises financial concerns for producers, many of whom are now seeking federal assistance and insurance payouts to offset growing losses. If not swiftly addressed, the pest outbreak could undermine Mexico's sugar sector stability, disrupt local mill operations, and eventually shift trade dynamics, especially in regional markets reliant on Mexican supply.

In W28, Pakistan's sugar prices held steady at USD 0.62/kg, unchanged from the previous week but up 24% YoY from USD 0.50/kg in W28 2024. The sustained price increase reflects mounting pressure in the domestic market, where retail sugar prices have surged significantly since Jan-25.

To mitigate further inflation and stabilize domestic supply, the Trading Corporation of Pakistan (TCP) has issued an international tender to import between 300,000 and 500,000 mt of refined sugar. Offers are due by July 18, with shipments expected in staggered consignments beginning in Aug-25 and concluding by September 30.

While the price has temporarily stabilized, the upcoming import volumes could exert downward pressure on domestic sugar prices in the short term, provided the procurement is completed efficiently and promptly. However, any logistical delays or inadequate supply responses may limit the government's ability to curb retail inflation, maintaining upward price risks through Q3-2025.

Given persistent global sugar surpluses and rising trade restrictions, such as the EU’s sharp quota reduction on Ukrainian sugar and Argentina’s resistance to liberalized Mercosur trade, exporters in Brazil, Ukraine, and Mexico should secure alternative buyers in under-supplied regions (e.g., MENA, South Asia). Establishing flexible destination contracts and risk-adjusted pricing strategies will help mitigate dependency on traditional markets facing protectionist policies or structural shifts.

Governments and industry stakeholders in countries like Vietnam and India should intensify efforts to shield domestic markets from low-priced competition and input substitution (e.g., HFCS and grain-based ethanol). This includes stricter enforcement against sugar smuggling, strategic incentives for industrial use of cane sugar, and policy realignment to restore molasses-based ethanol quotas. Promoting value-added products such as specialty sugars or processed sweeteners can also improve margins and sustainability.

Sources: Tridge, Agre Infos, Agro Popular, Ukr AgroConsult, Canal Rural, Infobae, Agro Link, Food Business News, Nación 123

Read more relevant content

Recommended suppliers for you

What to read next