News

Original content

In the Paraguayan Chaco, agricultural growth has slowed, leading some producers to abandon crops like peanuts, soybeans, and cotton after years of losses. As a result, many agricultural plots are being converted back to pastoral land, suitable for bale production for livestock. Weather conditions have hindered peanut yields, with some areas opting to plant corn instead of other crops as the planting window for peanuts has passed.

The European Union's (EU) recent tariffs on United States (US) goods, including peanut butter, are unlikely to significantly affect the Wiregrass region's peanut industry, the Executive Director of the Alabama Peanut Producers Association (APPA) said. While the region is a major peanut producer, most peanuts are consumed domestically, with around 80% used in peanut butter, candies, and peanut oil. APPA's Director emphasized that domestic consumption will mitigate any potential impact on peanut prices or peanut butter costs.

Mid-season heat stress and drought stress (HS+DS) significantly impact peanut growth in Virginia, reducing yields by up to 50% and lowering kernel quality, which directly affects market pricing. For Virginia-type peanuts, prized for their large kernels and high grade, HS+DS diminishes both yield and the percentage of total sound mature kernels (TSMK), reducing profitability. Commercial cultivars generally retain higher quality under stress, while breeding lines perform better in rainfed conditions.. Underscoring the importance of breeding resilient peanut varieties to protect both yield and market value, particularly for Virginia's agricultural economy.

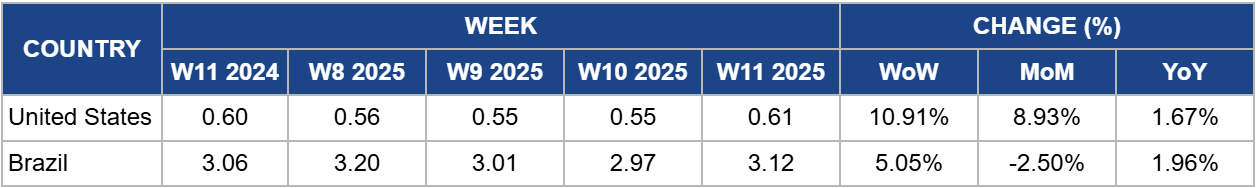

US peanut prices rose to USD 3.12 per kilogram (kg) in W11, up 5.05% week-on-week (WoW) and 1.96% year-on-year (YoY), driven by supply constraints and strong domestic demand. The EU's tariffs on US peanut butter are unlikely to disrupt the market, as 80% of US peanuts are consumed domestically, limiting export dependency. However, mid-season heat and drought stress in Virginia have severely reduced yields and kernel quality, particularly for Virginia-type peanuts, impacting overall market supply. While commercial cultivars maintain better quality, continued breeding efforts for stress-resistant varieties will be crucial to stabilizing future prices and ensuring supply resilience.

Brazil's peanut prices reached USD 3.12/kg in W11, reflecting a 5.05% WoW increase and a 1.96% YoY rise. This price surge is influenced by ongoing drier conditions in Southern and Eastern Brazil, where high temperatures and low soil moisture levels have stressed crops. Key growing areas, particularly from Rio Grande do Sul to Piaui, are experiencing below-normal soil moisture, which could impact peanut yields and quality. While southern states like the Rio Grande do Sul are less affected due to crop focus on corn and soybeans, the moisture shortage in regions growing Safrinha corn and peanuts (e.g., Paraná and Mato Grosso do Sul) raises concerns for future crop production. If conditions persist, further price increases could occur as reduced supply could push up market prices, especially in global markets reliant on Brazil's output.

To counter the negative impacts of heat and drought stress on peanut yields, particularly in Virginia, farmers should focus on developing and planting more resilient peanut varieties such as 'Walton' and 'Bailey II'. Collaborating with agricultural research institutions to develop climate-resistant peanut varieties will help stabilize yields and maintain quality. Additionally, implementing climate-smart farming practices such as water-efficient irrigation can further mitigate weather risks.

With the rising peanut prices in Brazil due to weather-related challenges, producers should explore expanding into new global markets to diversify demand. Targeting regions such as Africa, Asia, and the Middle East can help stabilize prices and reduce reliance on any single market. Strengthening trade relations and securing new export contracts can protect against the volatility of local markets.

Sources: Tridge, Agro Meat, Nature, WDHN, Progressive Farmer

Read more relevant content

Recommended suppliers for you

What to read next